Hi, Thanks for being a subscriber to Fairway Research. This is my first shallow dive on a stock. A shallow dive is meant to be a high level overview of the business. It is also meant to lay down ground work for a future deep dive on the company. Shallow dives will only focus on particular aspects of businesses such as revenue breakdown, strategy, certain corporate events etc., and will not be comprehensive. Particularly, there will not be any discussion on intrinsic valuation since I just don’t know enough about the company. But I will leave you with links to useful resources if you want to know more about business. I will also try to keep these under 5 minutes of reading time.

Thoughts on small cap stocks

I have been toying with the idea of whether small cap stocks belong in my portfolio. Ideally, I would like my portfolio companies to be of a certain size and scale. Just to put a number to it, say companies above $300 million in market capitalization. Such businesses have detailed annual reports, investor presentations and conference call transcripts to help me get a better sense of the business. Small cap stocks often lack information because they cannot afford to have a proper investor relations department. However, analysing Atlas Engineered Products (“Atlas”), which has a market cap of only $50 million, has made me realize that studying small business can sometimes bring a different type of satisfaction. Why do I say that? In my experience, small businesses:

have simple stories and evolution which can generally be summarised in 1-2 pages

have 2-4 main products which cater to a particular niche market

tend to be driven by 2-3 main players in the management

have easy to understand financial statements and historical data

In my view, Atlas embodies all the above characteristics. Since this is a shallow dive, I borrow heavily from write-ups and research reports previously written about Atlas by others on FinTwit. All figures are in Canadian dollars, unless stated.

Atlas Overview

Ticker: AEP

Exchange: TSX Venture

Market Cap: $52 million

Enterprise Value: $55 million

LTM Revenue: $61 million

Auditor: PwC

Business Description: Atlas designs, manufactures, and sells engineered roof trusses, floor trusses, and wall panels in Canada. The company’s main customers are builders of residential and commercial wood-framed buildings, including single-family homes, townhouses, multi-story wood-framed residential buildings, commercial buildings, and agricultural structures. The company was incorporated in 1999 and is based in Nanaimo, Canada.

Product Revenue Breakdown:

Atlas makes 76% of the its revenues from trusses. A wood truss is a structural frame that relies on a triangular arrangement of shorter lengths of lumber and are important for the structural integrity of the building.

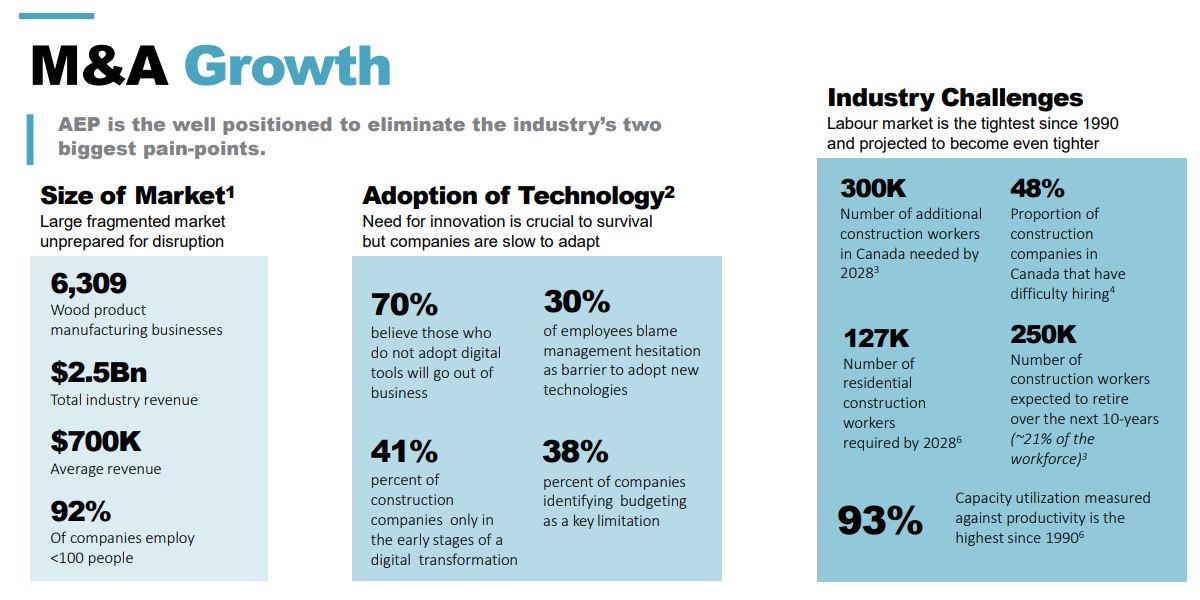

Strategy: Atlas is a serial acquirer. It operates in a highly fragmented industry with over small 200 truss manufacturers in Canada. Truss manufacturers in Canada are mostly mom and pop establishments which have $3-$15 million in revenue. Atlas opportunistically buys companies which are small in size and have no succession plan or exit strategy in place. The serial acquirer strategy has made Atlas one of the largest truss manufacturers in Canada (among the top 2, other one being a PE firm based in Winnipeg).

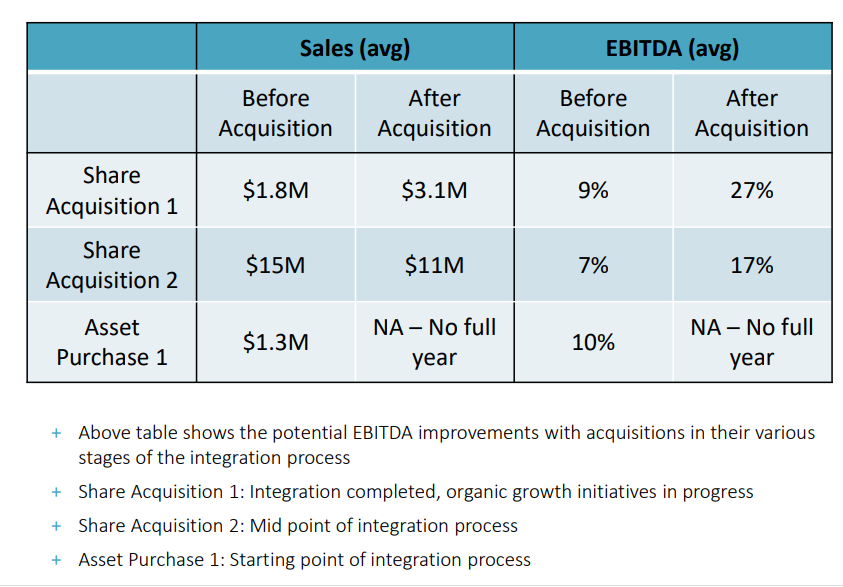

Between, 2018 and 2022 Atlas acquired 8 companies for close to $28 million (including land) in total. The average deal size was $3 million. Atlas on average paid 4x EBITDA for the acquisitions. Currently, Atlas itself also trades close to 4x LTM EV / EBITDA.

The roll up strategy of Atlas has benefits such as increasing efficiencies post acquisition by reducing redundancies (synergies). For example, Atlas can quickly improve EBITDA margins of the acquired companies by centralizing functions such as accounting and admin. Atlas can also consolidate raw material (lumber) supply, develop manufacturing best practices and adopt automation. Independent operators do not have the financial resources needed to improve operations and adopt automation. Atlas also has a dedicated sales team which it can leverage to drive revenue for the acquired businesses. Independent facilities often have customer relationships concentrated with the owners themselves.

Risks:

Atlas’ material cost is 46% of revenue. Its main raw material is lumber which has seen huge volatility in prices over recent years. While the price of lumber has stabilized as of January 2023, any future increases in lumber prices can put pressure on Atlas’ margins as it cannot pass on the increase in cost to customers immediately.

Atlas’ business is also heavily dependent on housing starts. As per forecasts, the housing starts in Canada are expected to be weaker in 2023 and 2024 as compared to 2021 and 2022.

Conclusion

Atlas moves into my watchlist for the next 2 to 3 quarters. I will be closely tracking and studying the company to get more comfortable around the business and managements next acquisition. If you are interested to learn more about Atlas the below sources might be helpful.

Further reading:

Report by COROA Equity Research

Small cap discoveries interview with Atlas CEO, Hadi Abassi:

Write up by Simon Handrahan:

This is another web to follow;

https://www150.statcan.gc.ca/n1/daily-quotidien/230404/dq230404a-eng.htm

https://globalnews.ca/news/9604857/cost-concessions-needed-meet-bc-housing-demand/