Sleep Country - Deep Dive (TSX: ZZZ)

Resilient Retailer Vs. Uncertain Times

Thank you for being a subscriber to Fairway Research. Before we get into deep dive #6 on Sleep Country Canada, I want to share that Fairway Research has gone soft-paid. It means that all content is still free but if you want to support my work, you can do so by buying a monthly or annual subscription. It is entirely optional and up to you. These deep dives are fun but also a lot of work and I hope you see value in them. I appreciate your support and readership.

As always you can download this report in a PDF for a much better reading experience. I suggest reading it on a tablet or desktop. Now let’s get into Sleep Country.

Please note that this report is not investment advice. Fairway Research may or may not hold positions in the stock discussed. Please do your own due diligence before investing.

Executive Summary:

Sleep Country is Canada’s largest specialty mattress retailer with an estimated market share of 37% as of 2022. The company has a coast-to-coast retail network of 289 stores supported by 20 warehouses.

In addition to being the leading brick-and-mortar retailer in Canada, Sleep Country also owns e-commerce mattress and accessories brands such as Endy (bed-in-a-box), Hush (weighted blankets), and Silk & Snow (bed-in-a-box). Most recently, Sleep Country acquired the Canadian operations of the U.S. DTC mattress brand, Casper.

In 2022, Sleep Country had revenue of $929 million, out of which 80% came from retail stores and 20% from e-commerce. In terms of product revenue, 76% of Sleep Country’s revenue comes from mattresses and the remainder from the sale of accessories such as pillows, duvets, etc.

While the mattress industry has been in turmoil, Sleep Country has delivered strong financial performance along with an increasing market share in Canada from 23% in 2015 to 37% in 2022. This was a result of consistent investment in the brand, the fall of Sears, which was a major competitor, and taking share from smaller independent mattress retailers.

Mattress firms performed exceptionally well during 2020-2022. This was primarily driven by pandemic stimulus spending and the increased focus of households on home-related expenses as people spent more time at home. As interest rates started increasing in 2022, Sleep Country’s same-store sales quickly turned negative.

I believe that the market is currently pricing a severe recession for Sleep Country. It currently trades at an EV / EBITDA multiple of 5x, which is the lowest since its IPO in 2015. In addition to acquiring companies at lower multiples, the management has been smart to use the current valuation levels to buy back over $50 million worth of stock in 2022.

Using a discounted cash flow model and very conservative assumptions, I estimate that Sleep Country’s intrinsic value per share is $30, representing a 30% upside from the current levels.

A. Introduction

In this report, we take a deep dive into Sleep Country Canada Holdings Inc. (TSX: ZZZ) (“Sleep Country”). Sleep Country is Canada’s largest specialty mattress retailer with an estimated market share of 37% as of 2022.

For my readers, I want the core takeaways from this report to be a good understanding of Sleep Country’s business and how the market seems to be overly pessimistic about its prospects.

The main sections of the report are:

Section B: discusses the pre-IPO and post-IPO business history of Sleep Country.

Section D: discusses the high-level structure of the mattress industry in Canada.

Section E: discusses the business of Sleep Country by breaking it down into 2 main segments, brick-and-mortar, and e-commerce. This section also goes into Sleep Country’s brand.

Section F: discussed how Sleep Country has managed to increase its market share despite other players struggling.

Section G: tries to understand the impact of a recession on the mattress industry and the implications for Sleep Country.

Section H: discussed the historical financial performance of Sleep Country including same-store sales growth.

Section J: uses a discounted cash flow methodology to estimate the intrinsic value of Sleep Country.

Figures in the report are in Canadian dollars unless otherwise noted.

B. Business History

i. Pre-IPO

A gap in the market

Sleep Country was founded in 1994 by Christine Magee, Stephen K. Gunn, and Gordon Lownds with four stores in Vancouver. Gunn and Lownds were partners in a boutique investment banking firm involved in the leveraged buyout of mattress manufacturer Simmons Canada. Through their involvement in that transaction, they realized that distribution channels for mattresses to the customers were not effective. Gunn and Lownds had known Magee in her days as a banker at National Bank. Gunn and Lownds brought Magee on board, and together the three launched the first four Sleep Country locations in Canada. By 1996, it had expanded to Toronto with 19 new stores; by 2001 it had 72 stores. In 2003, Sleep Country converted to an income trust and raised $120 million in its first IPO.

Quebec Acquisition

In 2006, Sleep Country acquired 5 stores in Dormez-Vous Sleep Centres, a Montreal-based mattress retailer which was started by Steward Schaefer, who came over to Sleep Country with the acquisition and took over as the CEO in 2022. Schaefer admitted that his strategy early on was to imitate what Sleep Country was doing in the market and bring it to the Quebec market.

The American misadventure

In 2006, Sleep Country also acquired the 32 stores of Sleep America LLC. However, this turned out to be a misstep as they purchased Sleep America at the peak right before the housing crash. Sleep Country grew much quicker in Canada as the competition was less intense as compared to the U.S. The company later sold Sleep America in 2015 for half of what it had paid nine years earlier.

Buyout by private equity

In 2008, the Sleep Country Income Trust was acquired by a group of investors led by Birch Hill Equity Partners and the company management for $356 million.

Back to the markets

After staying away from the markets for seven years, Sleep Country completed its IPO on the TSX by raising $300 million and began trading under the ticker symbol (ZZZ).

ii. Post-IPO

In 2018, Sleep Country acquired Endy, a Canadian bed-in-a-box online retailer. In 2021, it acquired Hush Blankets, a DTC e-commerce sleep retailer. In early 2023 it acquired Silk and Snow, another DTC sleep retailer. Most recently in April 2023, Sleep Country announced that it is acquiring the Canadian operations of the U.S. DTC mattress brand, Casper.

As of December 31, 2022, Sleep Country had 289 company-owned stores in Canada under the Sleep Country and Dormez-vous brands. The company also has 17 Sleep Country Express / Dormez-vous Express stores in partnership with Walmart Canada. Sleep Country currently holds an estimated 37% market share in Canadian mattress retail.

For the year ended December 31, 2022, Sleep Country had revenues of $929 million. The company has around 1,600 full-time associates on its payroll.

C. Stock Performance

After listing at close to $15 per share in 2015, Sleep Country’s share rose to $41 in June 2017, before sliding downwards and staying close to $20 during the whole of 2019. In March 2020, Sleep Country’s share fell to $9.3 per share driven by pandemic store closures, before slowly recovering to all-time high levels of $40-$41 per share in November 2021. Sleep Country also delivered one of its strongest financial performances in 2021. Throughout 2022, Sleep Country’s share steadily corrected on recession fears, falling consumer confidence, rising interest rates, and a decrease in same-store sales. As of April 19, 2023, Sleep Country’s share trades at $23.57, with a 52-week high of $29.91 and a 52-week low of $19.66.

Figure 1: Historical Stock Performance

D. Mattress Industry Landscape

Before understanding Sleep Country’s business, it is important to understand how the mattress industry works.

Figure 2: Canadian Mattress Industry Landscape

Mattress Manufacturers

Tempur Sealy and Serta Simmons are amongst the largest mattress manufacturers in the world. Purple Innovations is another up-and-coming mattress brand with more focus on the DTC space.

Tempur Sealy had 2022 revenues of close to US$5 billion and a 38% market share in the U.S. 77% of Tempur Sealy's revenue came from the wholesale channel, i.e., via mattress retailers such as the Mattress Firm, Walmart, and Costco. Only ~6% of Tempur Sealy’s revenue is estimated to come from Canada.

Serta Simmons is estimated to have $2.2 billion in revenue, however, it currently going through bankruptcy proceedings in the U.S.

Purple Innovations had revenue of $0.6 billion in 2022 with 43% revenue coming from the wholesale channel. However, Purple had minimal revenue outside the U.S. Purple has an exclusive partnership with Sleep Country for the Canadian geography.

Mattress manufacturing firms often have significant customer concentration. In 2022, 15% of Purple and Tempur Sealy’s revenues came from a single wholesale customer.

Mattress Distribution

The Canadian mattress retail industry is estimated to be $2.5 billion in size.

Omni Channel

Omnichannel distribution means that the retailer has a presence in both brick and mortar as well as online.

In Canada Sleep Country is the largest omnichannel mattress retailer with an estimated market share between 35% to 40%. In April 2023, Sleep Country entered into an agreement to acquire the Canadian operations of Casper, a leading U.S. DTC mattress brand that entered the Canadian market in 2018. LGL Group which owns the Brick and Leon’s furniture stores has the second largest market share in Canada after Sleep Country.

Other major omnichannel mattress retailers include Ashley, IKEA, and Quebec-focused BMTC Group which runs the Brault & Martineau store and EconoMax stores. Costco and Walmart Canada also sell mattresses both through their marketplace websites and stores.

Direct to Customer / Online / Bed-in-a-box

The bed-in-a-box industry was touted as a disruptor of brick and mortar dominated mattress industry. In the U.S., online mattress retail accounts for $6 billion out of $18 billion in industry revenue. Amazon is the largest DTC mattress retailer with estimated revenues close to $2 billion, followed by Resident at $600 million and others such as Avocado Green brands, Saatva, and Wayfair.

In Canada, Sleep Country-owned, Endy, which it acquired in 2018, is the largest bed-in-a-box brand. If we consider U.S. DTC sales as an indication, Amazon.ca is likely the largest DTC mattress seller in Canada, followed by Wayfair. Goodmorning.com and Polysleep are other DTC mattress retailers in Canada.

Mattress purchase decision

A mattress is a big-ticket infrequent purchase, and it is difficult to compare models and brands. As per UBS Evidence Lab, a U.S. survey of 2,500 consumers indicated that 43% of participants bought a mattress online, while 42% purchased a mattress in a brick-and-mortar store. Another 15% was purchased through both channels. Since it is such a personal product it is important to test the product before buying it. Customers often require the help of sales associates, to help select the right model.

An estimated 75% of mattress sales are for replacement. A typical mattress has a life of between 7 to 10 years. However, this figure has been shrinking over time. The time consumers have kept a mattress before replacing decreased from 10.3 years in 2007 to 8.9 years in 2016.

Mattresses are also among the first purchases to be delayed in case the money is tight making them highly discretionary products. But since a mattress is a necessity and not a fashion item, the purchase is generally delayed rather than lost. Consumer preferences have also been evolving towards premium quality and larger mattresses. The mattress industry is also able to pass on any increases in inflation to the customers. (See Figure 3)

Figure 3: Increase in mattress average selling price

Else than replacement, other triggers for mattress purchase include buying a new house, starting a new family, getting divorced, or going to university. Another interesting statistic is that 90% of purchasing decisions around home goods such as mattresses are made by women.

Players in the mattress retailing industry compete on various factors such as store locations, service and delivery experience, price, product selection, and brand name recognition. It is no surprise that the most cited factor in the mattress purchase decision, for both outlets selected as well as the brand purchased, is price. For retailers, other determining factors include the selection of products, location, and previous experience.

E. Understanding Sleep Country’s Business

Sleep Country is the largest brick-and-mortar retailer of mattresses in Canada. Its business can be essentially divided into two parts. The brick-and-mortar stores and the e-commerce business. Figure 4 below lays out the Sleep Country House of Brands platform.

Figure 4: The Sleep Country House of Brands Platform

1. Brick-and-Mortar Stores

Sleep Country has a coast-to-coast network of 289 stores under the Sleep Country and Dormez-vous (Quebec only) brands. 12 of these stores are located in malls. It also has 17 Sleep Country Express / Dormez-vous Express stores in partnership with Walmart Canada. During 2022, Sleep Country’s retail stores generated $747 million in revenue contributing 80% of its total revenue. The retail stores primarily sell mattresses and accessories such as pillows, duvets, etc. At a consolidated level Sleep Country gets 76% of its revenue from mattress sales and the remaining comes from accessories. This translates to an average revenue per store of $2.6 million and revenue per sq. ft. of $531. This compares well to the revenue per store of the Mattress Firm, the largest mattress retailer in the U.S., which had a revenue per store of $2.3 million in 2021.

Sleep Country’s stores are generally about 5,000 sq. ft. and are located close to residential areas. The store network is curial to the mattress business because most customers still finalize purchase decisions in the store after trying the mattress. They might shortlist and compare products online; however, the final decision is generally made in-store.

Sleep Country’s retail network is supported by 20 warehouses across Canada which have over 1 million sq. ft. of warehouse space.

Figure 5: Sleep Country’s Coast-to-Coast Retail Network

Store / Unit Economics

As mentioned above, a typical Sleep Country store is about 5,000 sq. ft and on average has $2.6 million in revenue. This translates to revenue per square foot of $531 per year. A new store costs about $460K and generates revenue of $1.8 million in the first year of operations. The payback period is generally around 10 months. Of course, there can be some cannibalization of sales from existing Sleep Country stores in case of new stores in existing markets. Even if we assume that a store pays back itself in 12 months, it represents a return on incremental capital invested of 100%, which is very impressive.

Figure 6: Sleep Country Store Level Revenue

Figure 7: Sleep Country New Store Economics

The Brand

The common theme among retailers is the need to maintain a brand and the consistent advertising spend that is required. Sleep Country is already one of the most recognized brands in Canada. In the ’90s, Sleep Country filled the airwaves across TV and radio with its brief memorable jingle, which was rated as Canada’s catchiest advertising melody - “Sleep Country Canada / Why buy a mattress anywhere else?”.

From its early days Sleep Country preferred spending on TV and radio ads as compared to print ads preferred by the competition. Another uniqueness about Sleep Country was that co-founder Christine Magee remained the face and voice of the brand since its inception. A strategic move given the fact that 90% of purchase decisions for household products are made by women. In 2018, Sleep Country disclosed that it is able to convert 60% of its shoppers into buyers. An impressive percentage if true.

Figure 8: Co-founder Christine Magee has been the face of Sleep Country since its inception (1999 commercial).

Figure 9: Sleep Country’s Media and Advertising Spend

The company is often among the top radio advertisers in local markets. It spends close to 7%-8% of its revenue on media and advertising. Since Sleep Country is the only mattress retailer in Canada with a national scale, it also gets efficiencies in national advertising where it buys advertisements from media companies in bulk.

It is also an industry tradition for mattress manufacturers to help push local marketing where the retailer’s brand is advertised alongside. Below are some examples from Simba and Kingsdown.

Mattress delivery is the key to customer experience.

One of the key features of Sleep Country’s buying experience is delivery. Sleep Country’s deliveries are generally scheduled within a 3-hour window. Delivery people wear shoe covers to avoid spoiling the floors of the customer’s houses. This is important in Canada where we have snow covered environment for almost 5-6 months of the year. The delivery personnel can also take the previous mattress for recycling or donation, along with any packaging materials with themselves instead of leaving them at the customer’s house. This leaves the customers with a great last impression. Stores such as IKEA do not provide such services with their delivery. Small independent stores also can’t provide such services due to limited resources. Stores such as Ashley provide this service for an extra charge. Note that disposing of an old mattress generally requires the customer to hire a truck and take it to the community recycling center. So, Sleep Country’s delivery service elevated a real pain point for the customer. In 2022, Sleep Country spent 0.3% of revenue ($3 million) on recycling and donation of old mattresses.

A Saturated Brick and Mortar Market

Because the Canadian market is saturated, the growth of brick-and-mortar stores will likely be limited. In 2018, the management of Sleep Country estimated that it can have 1 store for every 100,000 Canadians, which considering the latest population statics as of 2023 would translate to about 390 stores. That is another 100 stores from the current figure of 289 stores. Of course, there are several factors that can have an impact on this estimate. The management has also identified 80 to 100 Walmart Canada stores for Sleep Country Express store-in-store concept. Competition from Leons and the Brick, IKEA, and especially the DTC segment led by Amazon and Wayfair can have a great impact on the market’s appetite for new Sleep Country stores. Since 2020, the number of new stores opened per year has considerably slowed down. The pandemic played a significant role in the slowdown.

Sleep Country has recently announced its intentions of revamping its current stores. This revamp is expected to give more square footage to bedding accessories, which have 10% higher gross margins as compared to mattresses.

Figure 10: Net New Stores

2. E-Commerce

Sleep Country launched its e-commerce division in 2017. Over the next 6 years, through a mix of acquisitions and organic growth, Sleep Country’s e-commerce revenues have grown to $182 million. Its two main acquisitions in the e-commerce space were the 2018 acquisition of Endy and the 2021 acquisition of the DTC brand Hush.

In 2018, Sleep Country acquired Endy which is the largest DTC bed-in-a-box player in Canada. Prior to Endy acquisitions, Sleep Country had launched its own bed-in-a-box brand “Bloom”.

In 2020, Sleep Country started disclosing its e-commerce revenue. In 2020, E-commerce revenue was $162 million representing 21% of total revenue. 2021 witnessed an exceptional growth of 33% over 2020, increasing to 24% of revenue. However, as the pandemic resided in 2022 and e-commerce sales decreased to $182 million, representing about 20% of total revenue. Below we discuss the acquisitions which have driven this e-commerce push for Sleep Country.

Figure 11: Sleep Country E-Commerce Revenue

i. Endy Acquisition (2018)

In 2018, Sleep Country acquired Endy for $89 million. The transaction included the payment of $64 million in cash and an earn-out of up to $25 million based on profitability targets for 2020. Endy was growing rapidly with 2018 revenue having grown over 150%. The cash component of the consideration was valued at 12x Endy’s LTM EBITDA. At the time of the acquisition Sleep Country’s own multiple was ~9x EBITDA. The acquisition was primarily financed through debt. Endy operates as a separate entity within the Sleep Country corporate structure. Through the acquisition, Sleep Country wanted to increase its participation in DTC segment growth and enhance its exposure to the online channel. Endy is currently the leading bed-in-a-box brand in Canada and is estimated to have revenue of $86 million in 2022.

ii. Hush Acquisition (2021)

In 2021, Sleep Country acquired a 52% interest in Hush which was started in 2017. 90% of Hush’s revenue came from weighted blankets. It paid $25 million for the majority stake at 9x Hush LTM EBITDA. At the time of the acquisition, Sleep Country’s own multiple was also close to 9x EBITDA. Sleep Country also agreed to acquire the remaining 48% by March 2023 at a valuation of 7x LTM EBITDA. The acquisition was financed through debt. Hush continues to operate as a separate business within Sleep Country with backend support in form of finance, warehousing, and distribution.

iii. Silk & Snow Acquisition (2023)

In early 2023, Sleep Country acquired Silk and Snow for an upfront consideration of $24 million. The consideration represented 5.6x LTM EBITDA. This is close to Sleep Country’s own traded multiple in 2023. Sleep Country agreed to a contingent consideration of an additional $19.5 million to be paid in 2026 based on Silk and Snow’s performance during 2023-2025. The transaction was financed through debt and cash on hand. Silk & Snow had revenue of $35 million in 2022, of which 94% came from mattresses.

iv. Casper Acquisition (2023)

In April 2023 Sleep Country acquired the Canadian operations of Casper Sleep Inc. for $20.6 million. Casper is one of the U.S. mattress industry’s most recognized brands. Casper’s Canadian operations had LTM revenue of ~$40 million with 6 retail stores, Casper.ca website, and partnerships with Costco, Indigo, The Bay, and Loblaws marketplace. In addition, Sleep Country invested US$20.0M in Casper via a 5-year convertible note, which will have the option to convert into an ~5% common equity stake in Casper.

Figure 12: EV / EBITDA multiples paid for acquisitions (based on cash consideration only, Ex. contingent Consideration)

Summing up Sleep Country’s acquisition strategy

Sleep Country has made smart acquisitions during the last 5 years. Between 2018 and 2022, Sleep Country spent $104 million on acquisitions. Year to date, it has already paid $44 million for 2 new acquisitions (Casper and Silk & Snow).

Whether it is Endy, which has now become the leading DTC mattress player in Canada, or the struggling Casper exiting the Canadian retail space, Sleep Country has been opportunistic when it comes to buying companies. In line with the decrease in its own multiple in the market, it has paid reasonable EV / EBITDA multiples for acquisitions. The higher multiple in Endy might be justified by the astronomical growth it was witnessing around the acquisition.

Sleep Country also seems to be getting minimal competition for deals. Leon’s, the second largest mattress retailer in Canada, has not made any acquisition since it acquired the Brick retail chain in 2013 for close to $700 million.

All acquisitions have generally had an element of contingent consideration which is a good risk mitigation strategy. Further, all acquisitions have been funded through cash on hand and debt, with no new equity raised for any acquisitions.

I will conclude this section on Sleep Country’s business with this quote from management which neatly sums up the house-of-brands strategy:

F. Dealing with Competition

Mattresses are a tough business.

The mattress industry is tough. Mattress retail is tougher. The Mattress firm, which is the largest mattress-focused retailer in the U.S. filed for bankruptcy in 2018 and had to close 700 stores. Competition from bed-in-a-box online retailers and a financial scandal at the parent company level were blamed for the Mattress Firm’s problems. Most recently it paused its plans to go public again citing volatility in the IPO market.

E-commerce in the mattress space isn’t easy either. Between 2011 and 2018 over 100 bed-in-a-box websites were launched. Casper, a unicorn bed-in-a-box startup launched in 2014, was the leader of the pack. In February 2020, Casper went for an IPO right before the global pandemic shut down the economy. Bad timing.

According to its latest annual report, Casper reported a net loss of nearly $90 million on revenues of $497 million in 2020. In November 2021, private equity firm Durational Capital Management bought Casper. In April 2023, Casper sold its Canadian operations to Sleep Country.

Another e-commerce bed-in-a-box retailer, Purple Innovations, has faced a similar fate. The company’s stock is down from a high of US$40 in early 2021 to US$2.7 in April 2023. The company has a net loss of US$90 million in 2022.

Sleep Country’s Market Share

While all this has been happening in the background, Sleep Country has been growing from strength to strength. It has managed to consistently increase its market share each year. In 2015, at the time of its IPO, Sleep Country’s market share was estimated at 23%. By 2022, Sleep Country estimated that its market share had increased to somewhere between 35 to 40%. While Canada is a much smaller market as compared to the U.S., the Mattress Firm, only holds a 20% market share in the U.S.

Figure 13: Sleep Country’s Market Share in Canadian Mattress Industry

But how has Sleep Country been able to consistently win market share?

One big push - the fall of Sears Canada

It got one big push when the second largest mattress retailer in Canada, Sears Canada, went out of business in 2017 - 2018. It was estimated that Sears held 15% of the mattress retail market share in Canada. This was eventually picked up by the remaining players such as Sleep Country. Specialty retailers such as Sleep Country in the mattress category, Leon’s and Brick in the furniture category, Future Shop in electronics, and Toys “R” Us are often cited as one of the reasons for Sears Canada going out of business.

Figure 14: Canadian Mattress Retail Market Share (Excluding Quebec) (2015)

Winning Market Share from Independent Stores

Sleep Country has also won market share from smaller independent mattress retailers, who do not have the resources to maintain a strong online presence. These stores especially suffered during the pandemic period when they were shut down for extended periods of time without any online infrastructure.

G. How bad can a recession be?

One of the main criticisms of retailers in the current environment is that they were over-earning during covid. The stimulus cheques flushed consumers with cash, resulting in an unprecedented increase in consumer spending. Especially for home furnishing products since people were spending more time at home. However, as interest rates increased, consumer sentiment quickly changed.

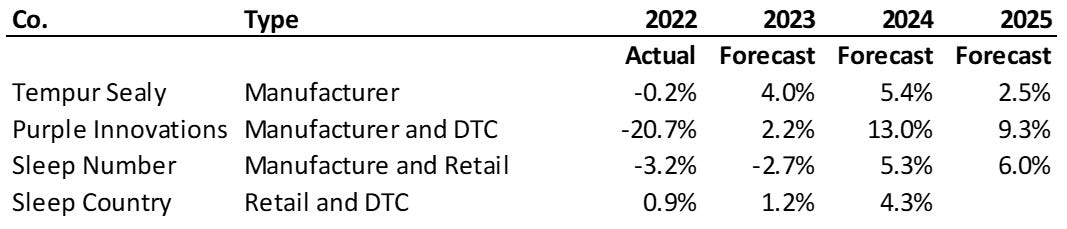

Sleep Country experienced negative same-store sales growth of 11% in Q3 and Q4 of 2022. This was in line with mattress manufacturer, Tempur Sealy which also saw revenue declines of 6% and 13% in Q3 and Q4 of 2022. So, it becomes important to gauge how bad a recessionary environment can get for Sleep Country.

Mattress Industry typically bounces back from recessions

Figure 15: US Mattress and Foundation Wholesale Market Revenue

If we consider the period during the 2008-2009 financial crisis, the U.S. mattress revenue decreased from $6.9 billion in 2007 to $5.7 billion in 2009, a decrease of 17.5%. It took the industry another 4 years to reach the revenue levels of $6.9-$7.0 billion. During the 2000-2001 tech bubble, the mattress industry sales were essentially flat for one year. Also, prior to 2020, the mattress industry had been flat for almost 3 years between 2017 and 2019. However, none of the other recessionary periods had a material impact on Sleep Country’s revenue.

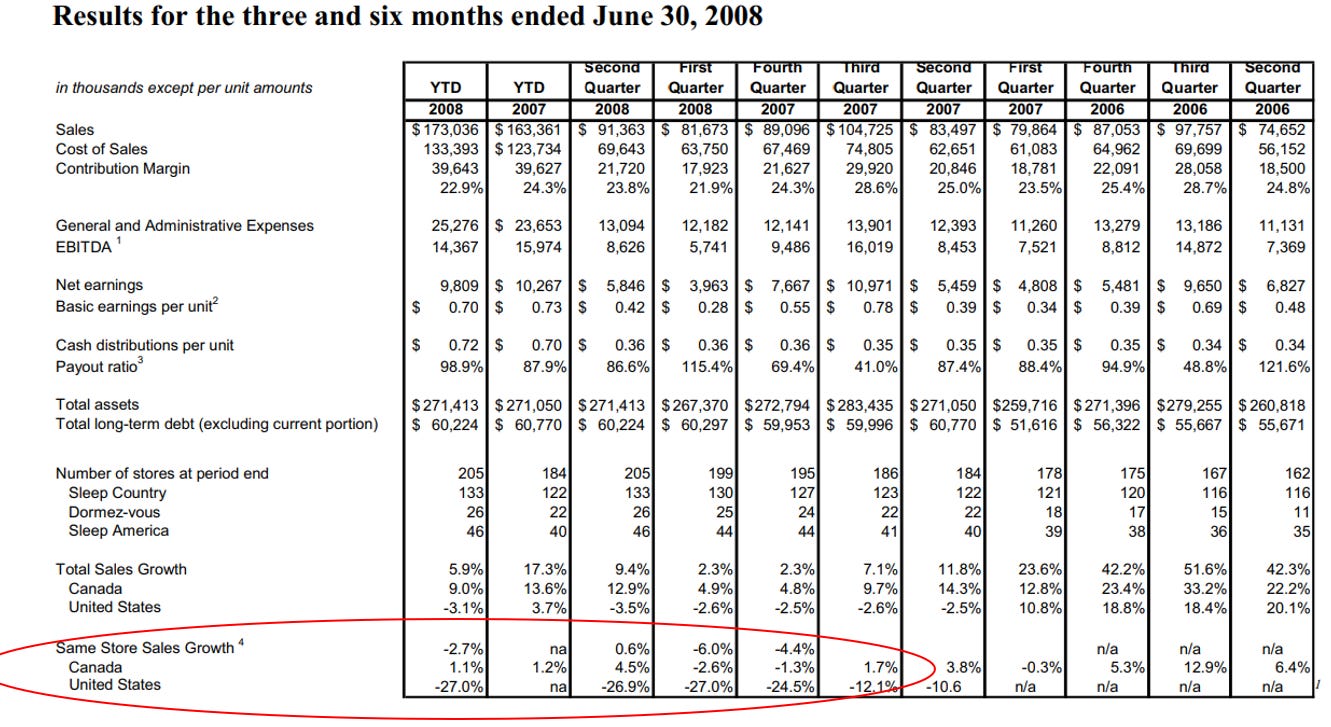

How did Sleep Country do during the great financial crisis?

During the 2007 to 2008 period, Sleep Country managed to increase sales by opening more new stores. But even with the increase in stores, its same-store sales growth in Canada was an impressive 4.5% during Q2 2008. As per Statistics Canada, sales at big mattress retailers slid 12 % in the first quarter of 2009.

If we consider the performance of Sleep Country’s US peer, the Mattress Firm during 2008 - 2009, it witnessed a same-store sales decrease of 24% in 2008 and another 4% decrease in 2009.

Figure 16: Sleep Country’s Results for the 6 months ended June 2008

While as investors we may say that 2023 is not comparable to 2007-2008, these are still good datapoint to help us access the downside risk. Another argument is that the current decrease in same-store sales is already higher than the decrease witnessed in 2008, notching up the risk of 2023 being worse than 2008.

Another data point is the expected growth rate as per the industry body. The International Sleep Products Association (ISPA) is predicting that the mattress industry in the U.S. will remain flat in 2023 and increase by 5.5% in 2024.

Another indication is the consensus analyst revenue estimates for various mattress manufacturers and retailers. Most consensus estimates currently project low or slightly negative growth in 2023 and then slightly higher growth in 2024 and 2025.

Figure 17: Consensus Revenue Growth Estimates as per Koyfin

We will take the above data points and incorporate them in our DCF assumptions in Section J.

H. Sleep Country’s Historical Financial Performance

Figure 18: Sleep Country Historical Financial Performance

1. Revenue growth

Sleep Country’s revenue grew from $587 million in 2017 to $929 million in 2022 at a CAGR of 9.6%. In 2022, 76% of revenue came from mattress sales and 24% came from accessories. During the previous 5 years, mattress revenue grew at a CAGR of 8% and accessories grew at 14%. Out of the total revenue of $929 million in 2022, 20% came from e-commerce and 80% was in-store sales.

Drivers of revenue growth:

Net new stores: From 2018 to 2022 Sleep Country opened 46 new stores and closed 4 stores. At the same time, it also relocated or renovated 90 stores. Sleep Country also opened 17 express stores in partnership with Walmart Canada during 2021-2022. Its average revenue per store grew from $2.1 million in 2020 to $2.6 million in 2022. At the same time, revenue per square foot of retail space was $531 in 2022, up from $437 in 2020 (note that retail stores were closed for part of 2020 due to covid restrictions).

Same-store sales growth: Sleep Country witnessed exceptional same-store sales growth during the second half of 2020 and the entire of 2021. But as interest rates started rising in 2022, same-store sales went negative. Prior to the pandemic, Sleep Country’s same-store sales growth rates had decreased substantially from the levels witnessed in 2016 and 2017 but had only been negative in 3 quarters.

Figure 19: Sleep Country’s Same Store Sales Growth %

E-commerce: Sleep Country witnessed mixed e-commerce revenue growth between 2020-2022. E-commerce revenue increased by 33% in 2021 and then decreased by 16% in 2022.

Sleep Country’s revenue generally has slight seasonality with higher sales in the third and fourth quarters.

2. Expenses

i. Cost of goods sold (COGS)

Sleep Country’s COGS before 2020 remained in the tight range between 69% to 71% of revenue. With exceptional revenue growth during the pandemic, Sleep Country’s COGS as a percentage of revenue has decreased to 63% in 2022. As per management the increase in gross profit during 2021 and 2022 was driven by higher average selling prices. Product costs improved from 46% of revenue in 2017 to 42% in 2022. Being the only national mattress retailer in Canada, Sleep Country must enjoy bargaining power against suppliers such as Tempur-Sealy and Serta Simmons. Salaries and wages also improved from 15% of revenue in 2017 to 13% in 2022.

Figure 20: Sleep Country COGS Breakup

ii. Operating Expenses

Sleep Country’s main operating expenses include media and advertising and salaries and wages. Media and Advertising have steadily increased from 5% of revenue in 2017 to 8% of revenue in 2022. I think that since Sleep Country was earning higher margins during 2020-2022 it invested more in its brand and as a result increased its market share. I also believe that these expenses are discretionary and can be reduced in years with challenging growth. The second major expense is cash leases which come to about 5% of revenue in 2022. Note that I make a separate adjustment for lease payment from EBITDA since it is a cash expense.

Figure 21: Sleep Country Operating Expense Breakdown

3. EBITDA

Adjusted for cash leases, Sleep Country’s EBITDA margin over the last 5 years has ranged between 15% (2019) and 18% (2022). The increase was primarily driven by an increase in gross margin and offset by the increase in media spending discussed above. I believe the increase in margin during 2022 will likely see a reversal of around 1% to 2% with long-term margins being in the range of 16%.

4. Working Capital and Capital Expenditures

Working Capital

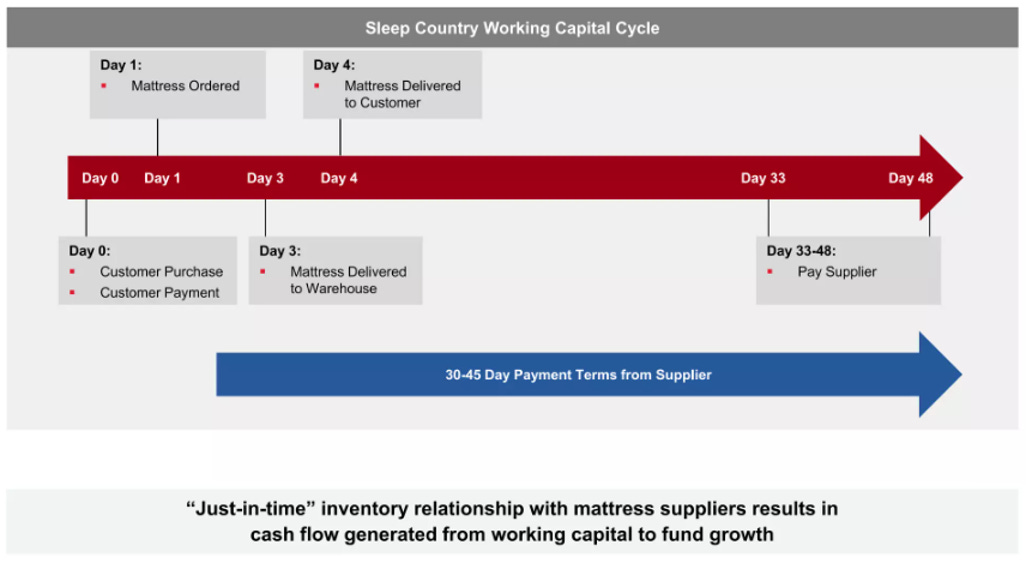

Sleep Country has maintained a negative working capital during the last 5 years. This is primarily because Sleep Country’s stores only have a few mattresses in inventory, mostly for showrooming. Sleep Country orders its inventory on a just-in-time basis once the customer has placed the order with them. Payment to suppliers generally goes out after 30 days. Over time, Sleep Country has been extending the payment period to suppliers from 46 days in 2017 to 66 days in 2022.

Figure 22: Sleep Country Working Capital Cycle (as of 2015)

However, Sleep Country sells accessories on a cash-and-carry model. This means that they need to keep more inventory in the stores as revenue from accessories increases over time. This has resulted in a bump up in inventory days from 34 days in 2017 to 61 days in 2022.

Capital Expenditure

Sleep Country’s capital expenditure over the last 5 years has averaged 3% of revenue. Out of this, about 1% is expected to be maintenance capex expenditure and 2% is growth capital expenditure.

Figure 23: Sleep Country Capital Expenditure (2008 to 2015)

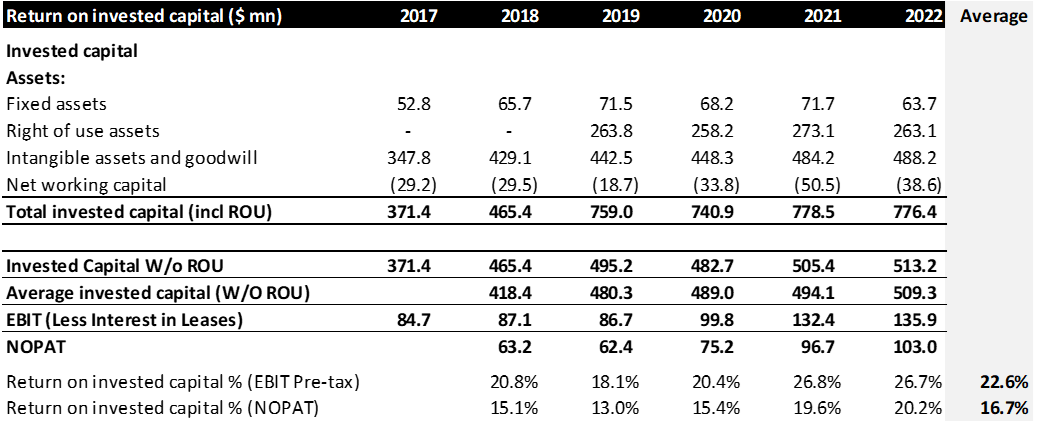

5. Return on Invested Capital

Over the last 5 years, Sleep Country’s return on invested capital has averaged 17% post-tax and 22.6% pre-tax. I calculate the return on invested capital using the below formula:

ROIC = NOPAT / Average. Invested Capital

NOPAT = (EBIT – Interest on leases) * (1- tax)

Invested Capital = PP&E + Intangible Assets and Goodwill + Working Capital – ROU assets

All of Sleep Country’s stores are on leases. Accordingly, I consider rent as a cash expense instead of dividing it up between depreciation and interest as per IFRS-16. For the computation of EBIT, I subtract interest on leases so that the entire cash rent expense is reflected in the EBIT. I also don’t consider ROU assets as part of invested capital in order to make an apples-to-apples comparison. I also add back one-time items such as ERP implementation costs and acquisition-related costs to EBIT. However, share-based compensation is not added back.

Figure 24: Sleep Country Return on Invested Capital

I. Management

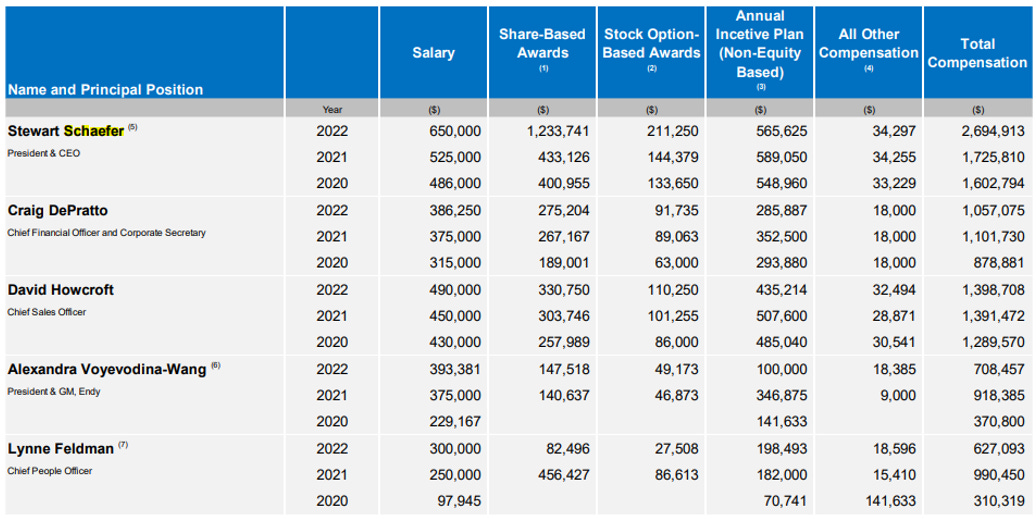

Steward Schaefer (age 57) took over as the CEO of Sleep Country in 2022. Before that, Mr. Schaefer served as the Chief Business Development Officer. He took over the reins from Dave Friesema, who left the business after seven years (2015 to 2021) as the CEO to retire.

Mr. Schaefer, a former commodities trader, has been working in sleep retail for the best part of three decades. He founded sleep retailer Dormez-vous in 1994, growing the business to a household name in Quebec with 5 stores, before being acquired by Sleep Country in 2006. Before that, he co-founded Heritage Classic Beds, a manufacturer, and distributor of iron and brass beds. Mr. Schaefer joined Sleep Country in 2006 as President of Dormez-vous and in 2014 he assumed the role of Chief Business Development Officer. In his role, he led the Company’s growth platforms and oversaw strategic partnerships and M&A opportunities.

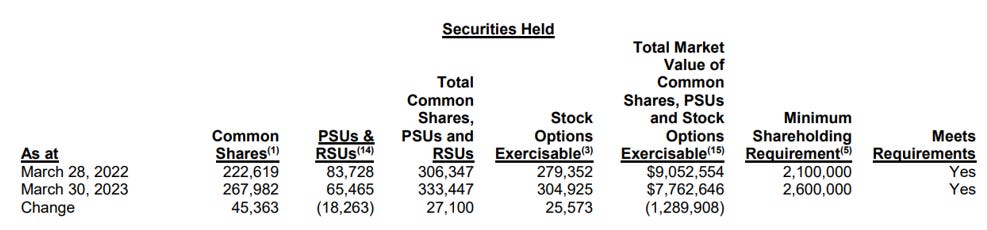

Mr. Schaefer currently holds close to 1.8% of the total share outstanding of Sleep Country on a fully diluted basis.

Figure 25: Executive Compensation of Sleep Country

Incentive Plans

Sleep Country’s short-term incentive plans are primarily based on EBITDA performance targets and its long-term incentive plans are based on basic EPS (75% weighting) and revenue growth (25% weighting).

Corporate Culture

Based on Indeed, Sleep Country Canada has the best rating among its competitors in Canada.

Capital Allocation

Over the last 5 years, Sleep Country’s capital allocation has been fairly balanced across various uses of cash flows. The company has not raised any outside equity and financial debt has remained at about the same level as in 2017. The company has invested $121 million in capital expenditure on maintenance as well as opening 42 net new stores and renovating and relocating another 90. It also spent $104 million on two big acquisitions of Endy in 2018 and Hush in 2021.

In addition to regular dividends, the company also bought back $58 million worth of stock in 2022. The management rationale for the buyback was that the company was trading at its lowest-ever multiples in the market. I believe the management of Sleep Country has maintained a very balanced approach to capital allocation. Instead of opening more and more stores to bump up revenue in 2022, the company focused on a significantly large buyback, clearly indicating they think that the company is undervalued. The management has further intentions to carry out buybacks in 2023.

Figure 26: Sleep Country 5-Year Capital Allocation Summary

J. Valuation: A recession is already priced in

Current Valuation

For the reasons discussed above, Sleep Country currently trades at the lowest EV / EBITDA multiple since its IPO in 2015. The market seems to be very pessimistic about mattress companies. The buoyancy seen during the pandemic has completely faded and a major recession is fully priced it. The concerns are legitimate. However, is the market overly pessimistic about Sleep Country’s prospects?

Figure 27: Sleep Country EV / EBITDA

Intrinsic Value Estimate

To compute the intrinsic value of Sleep Country I use a discounted cash flow model based on very conservative assumptions. I believe that even using very conservative assumptions the intrinsic value of Sleep Country is around $30 per share as compared to the current levels of $23 per share, indicating a 30% upside.

Key Assumptions:

Revenue: I assume that Sleep Country’s 2023 revenue will decrease by 10% to $836 million and then stay flat in 2024. Note that this is a highly conservative assumption as in early 2023 Sleep Country acquired Silk & Snow and Casper’s Canadian operations. Together these two acquisitions should contribute about $70-$80 million in additional revenue to Sleep Country. Post 2024, I assume Sleep Country's revenue will grow only at 3% each year. I assume that Sleep Country does not open any new stores. The assumption of a decrease in revenue is also in line with the decrease in revenue witnessed in the mattress industry during the 2007-2009 financial crisis which we discussed earlier in the report.

Further, given Sleep Country’s close to 40% market share as the only national bedding retailer, dominant position in the bed-in-a-box category in Canada, opportunistic acquisitions of DTC brands and competitors (such as Casper) exiting the Canadian retail space, these revenue assumptions are very reasonable.

Note that my assumption is highly conservative in comparison to consensus analyst estimates which indicate that revenue is projected to grow by 1% in 2023 and 4% in 2024. To illustrate further, my revenue estimate for 2027 is below the consensus revenue estimate for 2024.

Figure 28: Sleep Country Revenue Consensus Revenue Projections as per Koyfin

EBITDA: I assume Sleep Country’s EBITDA margin will decrease to 16% in 2024 and stay at that figure. Note that this is lower than the 16.9% and 17.5% EBITDA margins witnessed in 2021 and 2022.

Maintenance Capex: Sleep Country’s long-term average maintenance capex is around 1% of revenue. However, I conservatively assume 2% of revenue as maintenance capital expenditure.

Discount rate and LTGR: I assume a 10% discount rate and a 2% long-term growth rate.

Terminal value: My terminal value estimate based on a 10% discount rate and a 2% LTGR implied an exit EBITDA multiple of 8.3x in comparison to the current traded EBITDA multiple of 5x. So, there is an implied multiple expansion factored into the valuation.

Figure 29: Discounted Cash Flow

Figure 30: Sensitivity Analysis on Discount Rate and Long-term growth Rate (Intrinsic Value Per Share)

K. Risks

Low management ownership: Schaefer owns less than 2% of the company. However, it is important to note that he has been in the mattress space for almost 30 years now. Not only does he have the experience of starting his own mattress business, but he has also been part of Sleep Country's senior executive team since 2014. His incentive plan is focused on EBITDA, EPS, and revenue targets. This lowers the risk to an extent.

A longer road to recovery in consumer sentiment: Interest rates and inflation might take a while to come down to a more reasonable level.

Multiple rerating from 5x EBITDA to 8x EBITDA might take longer than expected or might not happen at all.

A. Conclusion

Sleep Country dominates the Canadian mattress retail space with a 37% market share, a national brick-and-mortar presence, and a well-known Canadian brand.

It also has a significant presence in the e-commerce DTC space with brands such as Endy, Hush, and now Casper.

The mattress industry is resilient and typically bounces back from recessionary periods within a few years. Industry association and consensus estimates are projecting flat sales in 2023 with higher growth coming in 2024.

The company is currently trading at a historically low EV / EBITDA multiple. The market has fully priced in a recession. The company’s management took this opportunity to buy back $57 million worth of stock in 2022.

My discounted cash flow model using conservative assumptions indicates that Sleep Country’s intrinsic value should be at least $30 per share. This represents a 30% upside from the current share price of Sleep Country.

Feel free to please share your suggestions, comments, or criticisms below.

Update May 9, 2023:

On May 9, 2023, the Mattress Firm, the largest mattress retailer in the U.S., was acquired by Tempur Sealy, the largest manufacturer of mattresses. The transaction represented a multiple of 9.3x EV/ EBITDA excluding synergies. This further solidifies my belief that the market is significantly undervaluing Sleep Country at the current levels.

Good writeup and interesting idea. Another point in favour is that there's a huge demographic tailwind in Canada and household formation should be above trend for a while which should provide an opportunity to expand store footprint.

Great write up.