SDI Group plc - Deep Dive

Mastering the ‘Science’ of Small Acquisitions

A big welcome to over 350 new subscribers who joined Fairway Research since my last deep dive. Today we dive into SDI Group plc, a UK based serial acquirer of niche manufacturing businesses. If you would like to read the report in PDF (highly recommended) please click on the below link to download the report. I also recommend reading on a desktop or tablet for the best experience. Happy reading.

Executive Summary:

SDI Group PLC (AIM: SDI) specializes in acquiring and operating niche manufacturing businesses in the life sciences, industrial, and scientific equipment and instruments sectors. Its revenue has grown considerably from £4.0 million in FY2014 to £49.6 million in FY2022, driven by the company's acquisition strategy. SDI operates in two primary business segments, Digital Imaging and Sensors & Control, and sells its products globally, with the UK, China, and Europe being its main markets.

SDI's management has been laser focused on acquiring businesses since FY2014, completing 16 acquisitions with a median deal size of £2.5 million and a median EV/EBIT multiple paid of 6.9x. The company targets a range of 4-6 times EBIT for new acquisitions. SDI's revenue growth has been a result of both organic and inorganic growth, with one-time Covid related orders for PCR machine products providing a significant boost to overall revenue in the past two years. However, this growth is expected to diminish in FY2024, which may negatively impact SDI's revenue growth, margins, and working capital.

Currently, SDI trades at an EV/LTM EBITDA multiple of 12.6x. However, excluding the EBITDA from one-time COVID-related revenue, the company effectively trades at 17.5x LTM EBITDA. To determine SDI's intrinsic value, we will use a discounted cash flow methodology to evaluate both its existing business and the potential value of acquisitions.

I conclude that while SDI's management has created an excellent mini-M&A machine, the current valuation is demanding. This is primarily due to the challenges SDI faces in meeting its high single-digit organic growth targets. Fairway Research does not hold a position in SDI Group.

A. Introduction

In this report we take a deep dive into SDI Group PLC (AIM: SDI) (“SDI”). SDI is a serial acquirer of niche manufacturing businesses based in Cambridge, UK. SDI’s businesses primarily include design and manufacture of various medical, industrial and scientific equipment and instruments. Over the last 8 years, SDI has acquired 16 companies. growing its revenue several fold from £4.0 million in FY2014 to £49.6 million in FY2022.

For my readers, I want the core takeaways from this report to be a good understanding of SDI’s business and helping you think about valuing a serial acquirer in a logical way. SDI is currently covered by two issuer paid research houses, and I believe this independent analysis will give a useful perspective to SDI’s existing investors as well as those currently learning more about the company.

The main sections of the report are:

Section D: breaks down in detail the business of SDI’s two segments, including products, services, end markets, price points, competition etc. It includes a discussion on all 14 businesses of SDI.

Section E: discusses the acquisition strategy of SDI, including multiples paid for all the acquisitions to date.

Section F: discusses the financial performance of the past 5 years with an emphasis on organic and inorganic revenue growth and the impact of one-time Covid related revenue.

Section G: discusses management background, capital allocation and insider ownership.

Section H: focuses on my estimate of intrinsic value of SDI using a two-part discounted cash flow model.

Figures in the report are in British pounds unless otherwise noted.

B. Business History

SDI was founded in 2008 with two subsidiaries, Atik Cameras and Synoptics, both engaged in digital imaging. SDI got listed on AIM in 2008 itself, with the intention to use the listing as a means of doing acquisitions in the digital imaging space. At the time of the initial listing, it had a market capitalization of £5 million. SDI did not raise any money through the listing.

Things did not go as per plan as SDI’s performance repeatedly missed market expectations, and the market capitalization eventually dropped to £3 million.

At that time, Mike Creedon, with his background accounting and turnrounds, joined SDI as a finance director to handle the M&A function. However, the then CEO of SDI retired soon after Mike joined SDI, making Mike take up the interim CEO position. For the next several years Mike functioned as both the CEO and CFO of SDI until they finally hired a new CFO in July 2018.

In 2014, SDI started its current M&A strategy, which it refers to as the “buy and build” strategy with the acquisition of Opus Instruments. It soon became apparent that there were not enough targets in the digital imaging space for SDI to pursue a meaningful acquisition strategy. Accordingly, SDI started pursuing targets in the broader scientific products space with a manufacturing bias which led to the formation of the Sensors and Control segment.

Initially the company resorted to issuing equity in order to facilitate the acquisitions, however, as SDI’s cash flows and debt capacity have increased, it has pivoted to using internal cash flow and debt for making new acquisitions. As of March 2023, SDI has acquired 16 different businesses.

C. Stock Performance

Over the previous 5 years, SDI has vastly outperformed the FTSE 250 index by returning at an annual CAGR of 37%. SDI has not paid dividends during its existence.

D. Understanding SDI’s Business

SDI divides its business primarily into two business segments, i.e., Digital Imaging Segment and Sensors & Control Segment. A common theme among SDI’s businesses is that they are marketed primarily to laboratories, medical and scientific markets.

At a very high level, the Digital Imaging Segment includes products such as high-performance cameras which are used in astronomy, industrial and life sciences applications (such as covid-19 testing PCR machines) and art conservation. It also includes products such as optics for microscopes and systems for gel documentation etc. For the last twelve months (“LTM”) ended October 31, 2022, the Digital Imaging Segment had revenue of £22.6 million and contributed 40% of SDI’s total revenue. SDI’s Digital Imaging segment benefited from the one-time orders for Atik cameras used in OEM manufactured PCR machines.

The Sensors and Controls Segment includes various products used in life sciences, medical and industrial markets. These include electrochemical sensors, chemical dosing systems, chillers, coolers and heat exchangers, flowmeters, lab cabinets, metal enclosures, sterilizers and anti-static products. For the LTM period ended October 31, 2022, the Sensors and Control Segment had revenue of £34.1 million and contributed 60% of SDI’s total revenue.

Figure 1: SDI Group Overview:

Note that ATC and Thermal Exchange merged in 2020.

While SDI’s businesses focus on very niche markets, its products are sold worldwide. SDI’s main sales geographies are the UK (43% of total revenue), China (22%), and Europe (15%).

Figure 2: SDI Group Global Presence

Figure 3: Geographic Revenue Bifurcation (FY2022)

We will now discuss the two segments and the various divisions within them in more detail. However, if you only wish to get a quick summary of various businesses of SDI see Figure 4 below. Another great way to understand SDI’s portfolio is to go this their link on their website, which has a listing as well as a small business description of all SDI businesses.

Figure 4: Short Business Descriptions

1. Digital Imaging Segment

The Digital Imaging Segment consists of three main divisions, i.e., Atik Cameras, Synoptics and Graticules Optics. We discuss these in detail below.

i. Atik Cameras Division

Atik Cameras manufactures cameras which are used for life sciences and industrial applications, deep-sky astronomy and flat panel display inspection. These are highly sensitive and high-performance cameras which are currently offered under two main brands, Atik and Quantum Scientific Imaging (QSI, acquired in FY2018). During Covid-19, Atik cameras were in demand for use in real-time PCR machines for detecting viruses. In 2018, SDI had disclosed that around 75% of Atik Camera sales were to OEMs.

While Atik is one of the top European astronomy camera manufacturers, it faces competition from Chinese manufacturers such as QHY, SBIG, ZWO. Atik and QSI cameras are sold anywhere between $1,300 to $8,000.

Under the Opus Instruments brand (acquired in FY2014), Atik also produces cameras which are used in art conservation. Opus Instrument cameras use infrared reflectography techniques, are used to examine artworks at auction houses, galleries, conservation studios and educational establishments.

All three camera brands are manufactured in Atik’s Lisbon (Portugal) facility. For an overview of Atik’s production facility see this video.

ii. Synoptics Division

Synoptics offers a range of instruments under four brands.

Syngene: develops and manufactures systems and software for analyzing and imaging gels and blots. Syngene’s products include GBOX and NuGenius. Application of these products include DNA detection, protein analysis, multiplex imaging, and fluorescence-stained gels. Syngene’s systems utilize the Atik Camera’s range of products. The GBOX is priced at between $10K to $27K depending on the model and specifications, while the NuGenius is available for ~$7K.

Synbiosis: Synbiosis develops and manufactures a range of automated colony counting and zone sizing products for the microbiology laboratory in food, water, pharmaceutical and clinical applications. Its ProtoCOL 3 system is used in all the major pharmaceutical companies for vaccine and antibiotic development and its high-end system, AutoCOL is the world’s first fully automated colony counter. The ProtoCOL 3 is priced between $14K to $21K.

Synoptics Health: This division offers ProReveal which is a highly sensitive fluorescence-based patented protein detection test for checking the presence of residual protein on surgical instruments after going through a washer disinfector process. ProReveal is the only commercial test currently available that complies with UK Department of Health (DOH) guidelines.

Fistreem (acquired in FY2019): Fistreem designs and manufactures water purification products and vacuum ovens. The Fistreem water distillers produce general laboratory grade water, which is used in glassware rinsing and washing, general environmental analysis, cell culture preparation, clinical biochemistry etc. Fistreem products are priced between $5K and $12K.

iii. Graticules Optics Division (acquired in FY2019)

Graticules is a designer and manufacturer of eye pieces for microscopes. Its best-selling product is horizontal eye piece reticle priced between £52 and £75. These products are consumables for the customers and provide a recurring revenue stream for SDI.

2. Sensors and Control Segment

i. Sentek (acquired in FY2016)

Sentek is the UK’s largest independent manufacturer of electrochemical sensors. Sentek manufactures and markets off-the-shelf and custom-made electrochemical sensors for water-based applications. These sensors are used in laboratory analysis, in food, beverage and personal care manufacture, as well as the leisure industry. Sentek’s electrodes are either single/limited use or have a working life of only six – twelve months, and must be replaced regularly, providing a repeat business revenue model for the SDI Group. Sentek occasionally enters into long-term supply agreements with companies for supplying sensors and also markets them through distributors. Sentek’s electrodes are priced anywhere between £60 to £325.

As an example of Sentek’s product application, to maintain hygienic food safety standards, the food and beverage industry relies on quality electrochemical measurement using Sentek’s custom & OEM electrodes. Recreational swimming pools and hotels & resorts with swimming pools depend on accurate testing to ensure that the pool water is safe and contains the right chlorination.

ii. Astles Control Systems (acquired in FY2017)

Astles Control Systems is a supplier of chemical dosing and control systems to different manufacturing industries including manufacturers of beverage cans, engineering and motor components, white goods, architectural aluminium and steel. The company supplies equipment with an average product life of ten years, as well as repeat business consumables, and servicing, and repairs.

ACS utilises many of Sentek’s electrochemical sensors in its product range.

iii. Applied Thermal Control and Thermal Exchange (acquired in FY2018 and FY2019)

ATC manufactures and supplies chillers, coolers and heat exchangers used within industrial, medical and scientific markets. These products are required to protect instrumentation, improve analytical repeatability and stability or remove heat from chemical reactions. The products are generally sold through distributors.

ATC chillers are well established in the scientific instrument support markets (electron microscopes, X-ray diffraction, ICPMS etc.), semiconductor process, ophthalmic lens manufacturing equipment, machine tool, commercial digital printing and laser lithography markets worldwide.

In 2020, Applied Thermal Control was merged with another subsidiary of SDI, Thermal Exchange, which manufactures industrial cooling systems.

iv. MPB Industries (acquired in FY2019)

MPB designs, manufactures and sells a range of flowmeters and control instrumentation with applications in water treatment, power generation, gas and oil production, human medical anesthesia, aviation, pharmaceutical, pollution control, scientific analysis, educational and many other areas. MPB’s products helped in the manufacture of ventilators for the UK during the outbreak of Covid-19. MPB competes with companies such as ABB, Hitachi, Honeywell, and Siemens in the flow meter space.

v. Chell Instruments (acquired in FY2020)

Chell designs, manufactures and calibrates pressure, vacuum, and gas flow measurement instruments for a variety of sectors including aerospace, vehicle aerodynamics, gas and steam turbine testing and power generation industries. Chell supports a number of leading Formula 1 racing teams with high-precision measurement equipment for aerodynamic testing.

vi. Monmouth Scientific (acquired in FY2021)

Monmouth designs, manufactures and services clean air solutions specialising in cleanrooms, biological safety fume cupboards and laminar flow cabinets. Monmouth’s biological safety cabinets were used in Covid-19 testing laboratories. To know more about Monmouth’s business, watch this video.

vii. Uniform Engineering (acquired in FY2021)

Uniform is a manufacturer of metal enclosures and housings used in a variety of applications including pharmaceutical, laboratory and safety equipment. Uniform uses precision metal fabrication, metal bending and powder coasting techniques in the manufacture of its products.

viii. Scientific Vacuum Systems (acquired in FY2022)

SVS specialises in custom Physical Vapour Deposition systems for the deposition of thin film coatings typically on semiconductor wafers, for use in scientific research, industrial and semiconductor manufacturing applications. SVS is a market leader in the manufacture of production sputter coaters for premium brand razor blade coating.

ix. Safelab Systems (acquired in FY2022)

Safelab produces high specification fume cupboards and similar cabinets, for both commercial and research laboratories and with a special focus on the education sector which requires versatile and ducted cabinets often specified in newly built or refurbished laboratory facilities.

Safelab’s main customer base is schools, universities and other institutions where they require a flexible fume cupboard. They also sell to building contractors which build new educational institutes.

x. LTE Scientific (acquired in FY2023)

Specialises in the design and manufacture of sterilizers, decontamination and thermal processing equipment, used in the life science and medical market sectors. LTE manufactures autoclave sterilizers, which sterilize objects placed in a pressure vessel by injecting steam under pressure at temperatures ranging typically from 105˚C to 137˚C. These are used in laboratories and hospitals. Other manufactured products include environmental rooms and chambers, endoscope storage cabinets, laboratory ovens, incubators and drying cabinets.

xi. Fraser Anti-Static (acquired in FY2023)

Manufacturer of antistatic products which eliminate, clean, generate or measure static electricity in a variety of industries including plastics, packaging, printing, food processing, medical and pharma amongst others.

3. SDI products from a consumer perspective

As can be seen from above, SDI’s portfolio includes a wide variety of products which are predominantly sold to business customers in the medical, industrial and scientific space. Accordingly, it is important to understand whether SDI’s products are capital expenditures for its customers or recurring operating expenses. As per SDI’s management, roughly 35% to 40% of SDI’s revenue is recurring in nature. These includes products which are consumables and periodic servicing of various other products sold by SDI.

Figure 5: Nature of Expenditure for Customer

E. SDI’s Acquisition Strategy

In 2014, SDI started its ‘buy and build’ strategy which it has been executing at a brisk pace. Between FY2014 and H1 FY2023, SDI completed 16 acquisitions, with a median deal size of £2.5 million and a median EV / EBIT multiple paid of 6.9x. It targets to pay between 4-6 times EBIT for new acquisitions. SDI often uses contingent consideration as a means to bridge negotiation differences with seller and mitigate performance risk.

Figure 6: SDI Acquisition Strategy and Process

Figure 7: Historical Acquisitions by SDI Group

Sourcing of acquisitions

SDI generally sources acquisitions through three routes:

1) using an intermediatory such as a corporate finance firm / business broker.

2) by asking internally who they should target to buy.

3) Having a reputation of being a good acquirer focused on helping owners get an exit, at the same time being a good home for the employees. SDI offers the potential seller(s) as a reference a meeting with the owners of businesses who have sold to SDI over the years.

Due diligence process

Mike Creedon does the due diligence for each acquisition himself. He sometimes takes the support on internal resources to help kick the tires on a new business.

Financing of acquisitions

Initially, SDI used to raise equity for completing acquisitions. However, once SDI had sufficient cash flows and debt capacity, it used those for new acquisitions. Out of the 16 acquisitions, SDI raised equity for three acquisitions, i.e., Sentek (October 2015), Astles Controls Systems (January 2017) and Graticules Optics (February 2019). Most importantly it has not raised outside equity post February 2019. Occasionally, when sellers wanted ownership in SDI, it issued a nominal number of shares as part consideration.

Figure 8: SDI Group Shares Outstanding

Post Acquisition Operations and Synergies

Post acquisition, SDI’s businesses operate autonomously as separate entities with support from the head office. SDI currently has 14 different business units. SDI also introduces stronger financial controls because prior to the acquisition most businesses have unaudited financials. The subsidiary managers/ directors prepare operational reports and budgets which are then consolidated at the head office level. The head office monitors the operations at a business level rather than at a segment level. About 70% of founders who sell their businesses to SDI stay on in some capacity even after selling to SDI. They are incentivized through an arm’s length salary and a bonus based on business performance.

The head office, which is only three people currently, also facilitates cross sharing of information between the business. Mike Creedon tries to visit the subsidiaries every six weeks and is on the road four days a week. Of course, there are synergy opportunities upon integration as well. As mentioned earlier, the outputs of some businesses are the inputs of others. For example, the cameras produced by Atik are used in the gel documentation machines produced by Synoptics.

Wherever it made a lot of sense to operate as a single unit, SDI has combined the operations. For example, Opus Instruments and QSI were merged into Atik Cameras and now all three are manufactured in Atik’s Lisbon facility. Fistreem was merged into Synoptics and Thermal Exchange and Applied Thermal Controls were also merged.

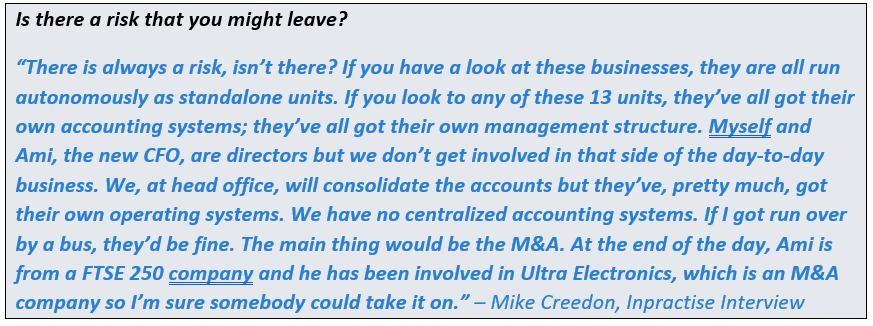

Here is a good concluding statement on SDI’s M&A strategy by the CEO:

F. SDI’s Historical Financial Performance

Figure 9: SDI Group Historical Financial Performance

1. Revenue growth

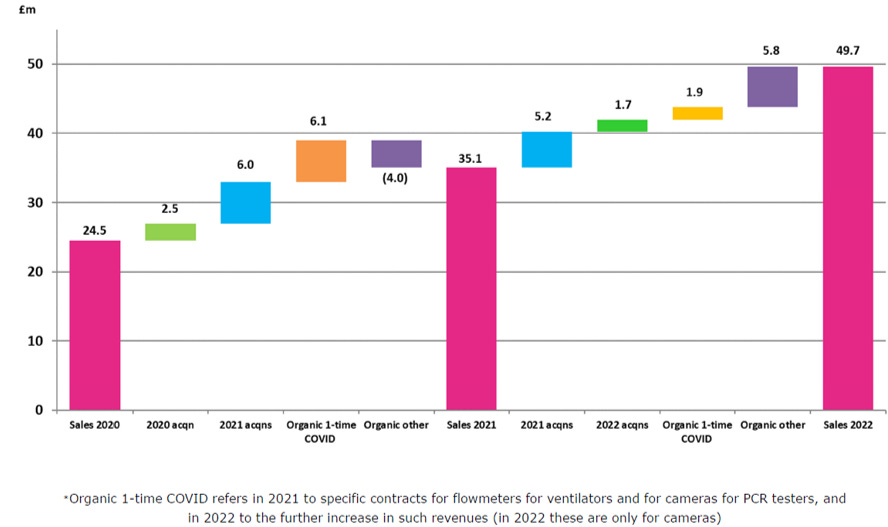

SDI’s overall revenue has grown from £14.5 million in FY2018 to £49.7 million in FY2022 at a compounded annual growth rate (“CAGR”) of 36%. This was driven by growth in both the segments. The Digital Imaging segment grew at a CAGR of 29%, and the Sensors and Control segment grew at a CAGR of 42%. In order to understand SDI’s phenomenal revenue growth, we must understand two important points about the revenue growth.

1. First, since SDI is a serial acquirer, we have to differentiate between organic revenue growth and acquired revenue growth.

2. Secondly, since SDI benefited from one-time sales during the pandemic (Atik cameras for PCR machines and flow meters for ventilators) we have to understand the growth excluding these one-time sales.

Organic vs. Acquired Revenue Growth

SDI’s management target for organic revenue growth is high single digits. SDI has met this target in three out of the last five years. It witnessed only 5% organic growth in FY2019 and 3.7% in FY2020. As can be seen from Figure 10 below, naturally majority of SDI’s revenue growth came from acquisitions.

Figure 10: Organic vs Inorganic Revenue Growth

Note that SDI’s management quoted 19% organic revenue growth in FY2021. However, that calculation seems to include revenue increase from FY2020 acquisitions. After excluding revenue from FY2020 acquisitions, organic revenue growth was 8.6% instead of 19%. In H1 FY2023, SDI’s organic growth decreased to 3.8%. SDI’s management attributed this to slower post Covid uptick at Monmouth and components delays at Astles and Chell.

One-Time Covid Related Sales

Figure 11: SDI FY2021 and FY2022 Revenue Bridge

Figure 12: FY2021 and FY2022 Revenue Growth Breakdown (Covid-19 Growth Broken Out)

SDI had £6.1 million of one-time Covid related revenue in FY2021, which grew to £8 million in FY2022. During the LTM period ended October 2022, the Covid related one-time revenue was £8.7 million. This revenue primarily related to two SDI businesses, i.e., Atik Cameras which supplied high performance cameras to a Chinese OEM for use in PCR machines, and second was flowmeters provided by MPB Industries for ventilators. The FY2022 revenue of £8 million only relates to Atik cameras.

Figure 13: SDI Group PLC Revenue Breakdown for FY2021 and FY2022

SDI’s management have highlighted at various points that this revenue will likely go away in FY2024. Accordingly, as investors it becomes extremely important to adjust for this one-time revenue when projecting SDI’s revenue and margins for future years. It also becomes critical to analyze SDI’s effective trading multiple after adjusting for one-time covid related sales and EBITDA. In my DCF valuation, I have specifically made an adjustment for these one-time covid related sales. Below are some quotes from the management on the one-time revenue:

In the most recent earnings call, Ami Sharma the new CFO of SDI made the following statements:

As I will discuss in the Valuation section, because this £8 to £9 million of one-time revenue will go away, it will have a considerable impact on SDI revenue and EBITDA for FY2024. While revenue growth might still be seen in FY2024 due to full year impact of FY2023 acquisitions and new FY2024 acquisitions, I expect overall revenue growth to be muted in FY2024. I discuss this in more detail in the Valuation Section.

Revenue bifurcation

As SDI has been making more acquisitions in the Sensors and Control segment, its revenue share has grown from 47% of total revenue in FY2018 to 60% of total revenue in the LTM period ended October 2022.

In terms of geographic revenue, SDI’s share of revenue from UK has increased from 34% in FY2018 to 43% in FY2022. This is probably due to most acquisitions being UK based. However, the more notable change is that share of Asia sales has increased from 23% in FY2018 to 31% in FY2022. Out of the 31%, 22% of sales are in China and 9% in Asia (Ex. China). These increases in shares for UK and Asia have come at the expense of Americas and Europe, both of which have shrunk since FY2018. However, once we adjust for one-time sales of Atik Camera’s to the Chinese PCR manufacturer, the share of Asia falls to 18% (China 7%).

Figure 14: Geographic Revenue Evolution

2. Operating Expenses

i. Cost of goods sold (COGS)

SDI’s COGS has been within a tight range of 32% to 37% during the last 5 years. This has helped SDI maintain steady gross profits levels in mid to high 60’s. Because each of SDI’s businesses are different, COGS does not seem to be dependent on one specific raw material input such as steel.

ii. Wages and Salaries

One of SDI’s main expenses is its employee costs which have on average been close to 32% of revenue in the last 5 years. Wages and salaries cost gets included on COGS and SG&A but is also reported separately in the notes to accounts. SDI’s businesses have labour intensive manufacturing processes. Out of 354 average total employees in FY2022, 193 or 55% were employed in production. Fortunately, SDI seems to have managed average salaries well in an inflationary environment. SDI average annual employee salary has stayed close to £40K over the last 5 years.

Figure 15: SDI Wages and Salaries

iii. EBITDA

SDI’s EBITDA margin has increased from 21% of revenue in FY2018 to 26% during the LTM period ended October 2022. This has primarily been driven by a decrease in SG&A costs as a % of revenue from 54% of revenue in FY2018 to 43% of revenue during the LTM period. Note that SDI has achieved this EBITDA margin increase despite slightly decreasing gross margins.

In terms EBITDA margins for SDI Segments, the Digital Imaging Segment has significantly higher EBITDA margins, at ~42%, as compared to the Sensors and Control segment which has EBITDA margins of ~19%. Since, the margins for the Digital Imaging segment have improved during the covid period, it likely indicates that the improvement in margins is linked to increase in one-time covid revenue for Atik Cameras. Note that prior to FY2021, the EBITDA margins for both the segments of SDI were similar at ~25%. Accordingly, once the £8 million of one-time revenue goes away, the Digital Imaging EBITDA margin will likely see some downward normalization. In my DCF analysis, assume the EBITDA margin on one-time covid related revenue of £8 million, is 42%, which will likely not repeat FY2024 onwards.

Figure 16: Segment EBITDA Margins (before corporate costs)

Segment EBITDA margins are computed by adding depreciation to segment adjusted operating profit.

4. Working Capital and Capital Expenditures

Working Capital

Prior to FY2021, SDI used to have a positive working capital position ranging between 11% to 14% of revenue. Working capital mainly composed of accounts receivable and inventories. However, during FY2021 and FY2022 SDI received full down payments for covid related sales to Chinese OEM manufacturer for Atik cameras which resulted in negative working capital during those years. As expected, the working capital position has quickly turned back to positive as of October 31, 2022, to 9% of revenue.

Figure 17: SDI Working Capital Levels

Capital Expenditures

SDI had average annual capital expenditure of ~4% of revenue. For the LTM period SDI had capital expenditures of £1,842K.

5. Return on Invested Capital

Figure 18: SDI’s Return on Invested Capital

SDI’s return on invested capital has improved significantly in recent years. From the respectable levels of 19% witnessed in FY2019 and FY2020 to 26% in FY2021 and 32% in FY2022. While ROIC has improved, it is important to note that a negative working capital position, due to the downpayment of one-time covid related order has skewed the return on capital upward. If SDI’s working capital at stayed had the same amount in FY2021 and FY2022 as at the end of FY2020, the ROIC for FY2021 would have been 24% and FY2022 would have been 28%. A noticeable improvement, nonetheless.

SDI buys companies at a median multiple 6.9x of EBIT. That simply translates to a ROIC of ~15%. This of course can be improved after realization of post-acquisition synergies. Naturally, the lower the multiple paid, or higher the synergies, the higher the ROIC.

G. Management

Mike Creedon - CEO

Personally, I am a fan of Mike’s humility. If you read or watch any of Mike’s interviews (see Section L -Useful Resources), you will notice that Mike is humble executive minus all the fluff which comes from management these days. He says things as they are. Before we get more into Mike’s background and how he built SDI, I request you to briefly look at this video for 30 seconds on how he likes to start the conference calls by showing off SDI’s modest head office setup. I enjoy it because I take it as a sign of the stewardship he feels towards the shareholders of SDI.

As mentioned before, Mike joined SDI when it was in pretty much in shambles. Stock was down 50% since listing no AIM, and the envisioned ‘buy and build’ strategy did not even get of the gate. Once he became the interim CEO, Mike started working along side the Chairman of SDI, Ken Ford, and slowly turned the business around over the next few years. In 2014, they made their first acquisition, Opus Instruments, and since then SDI has not looked back, completing 16 acquisitions in 8 years.

Prior Experience

Prior to SDI, Mike served as Finance Director at Innovision Limited, a subsidiary of the NASDAQ listed company, Leitch Technology Corp and as Finance Director of Ninth Floor plc, a company formerly on the Official List.

In 2006 Mike was appointed as Interim Finance Director at NextGen Group plc, an AIM listed company focusing on the design, manufacture and sale of services and equipment to the biotechnology and pharmaceutical sector, following which Mike acted as Chief Financial Officer at Durham Scientific Crystals Limited, a company whose principal activity is the development, manufacture and sale of products for the x-ray imaging market.

Personal Interests

Mike is a chartered accountant and earned his MBA from Henley Management College. He reads 40-50 fiction books per year and travels to various subsidiaries for 4 days a week in a rented petrol car. He personally drives a pick-up truck, is fond of tennis and horse riding. His favourite business books are Warren Buffet’s biography, Snowball, and his letters to shareholders of Berkshire Hathaway. He is an admirer of Judges Scientific, which some consider as a larger comparable of SDI and is following a similar acquisition strategy. Mike is also an admirer of Mark Leonard’s approach to M&A at Constellation Software.

Day-to-Day role at SDI

Mike describes his role as being two-fold:

1) Being on the road for four days a week (in a rented car) and travelling to various subsidiaries of SDI to meet with the people. He tries to visit each subsidiary within a period of 6 weeks.

2) Being responsible for M&A. Given his accounting training and turnaround experience, Mike carries out all due diligence on new transactions himself.

1. Capital Allocation

SDI’s management has been laser focused on acquisitions since FY2014. In the last 5 years, almost the entire cash flow from operations of £30 million has been reinvested into new acquisitions. Another £5.6 million has been reinvested into the business in form of capital expenditures. SDI has raised minimal amount of new debt between FY2018 and FY2022. However, note that as of October 31, 2022, SDI’s debt increased to £19 million to fund the LTE Scientific and Fraser Anti-Static acquisitions during FY2023.

Figure 19: 5-Year Capital Allocation of Summary

2. Ownership and Compensation

One of the biggest criticisms of SDI’s management from the investor community is the low insider shareholding. Mike Creedon currently owns 172.5K shares of SDI, which comes to about 0.17% of total shares outstanding. He recently sold a chunk of his shares, because Danske Bank wanted to buy 5% stake in SDI but there was no liquidity in the stock. Further some of the employees who had initially agreed to sell the stock, backed out at the last minute because they felt the stock price was not high enough. So, Mike sold some of his shares and gave some of the proceeds to his kids to help them ‘on the housing ladder’. No wealth diversification logic here. Mike has repeatedly mentioned that he is not motivated by wealth, but he loves his job.

It is important to note that Mike spear headed SDI from £2.5 million to £170 million in market capitalization. Any executive in that case would have loved to own more, but this is what Mike had to say about his low ownership in SDI:

Mike’s own remuneration has grown over the last 5 years; however, SDI’s profits have grown at much faster pace. Mike’s compensation as a % of net profit actually decreased from 11% in FY2018 and FY2019 to 4% FY2022.

Figure 20: Mike Creedon’s Remuneration

SDI has a long-term incentive plan (“LTIP”) in place for its management team. Performance conditions are based for 50% on the growth in fully diluted earnings per share and for 50% on the total shareholder return over three years for SDI shareholders compared with a basket of twenty comparable companies.

As of April 2022, Mike had options on another 774K shares of SDI including 63K share entitlements under the LTIP. The exercise price of the ordinary options ranges from £0.172 to £1.740, and of LTIP options is £0.010.

Since Mike has been so important to building up SDI, as an investor, one cannot ignore keyman risk. Here is what his response was when asked whether there is a risk that he might leave.

H. Valuation

SDI currently trades at an EV / LTM EBITDA multiple of 12.6x, based on the LTM EBITDA of £14.9 million. However, it is important to note that £8.7 million of the LTM revenue was one-time covid revenue for Atik Cameras, which we have already discussed in detail. If we assume that SDI earned 42% EBITDA margin on that revenue (in line with Digital Imaging segment’s LTM EBITDA margin), the covid adjusted LTM EBITDA actually comes down to £10.7 million. This adjusted EBITDA implied a traded EV / EBITDA multiple of 17.5x. Accordingly, what might seem like a fairly valued company at 13x EBITDA, is effectively trading at around a 40% higher multiple of 17.5x. In comparison, Judges Scientific plc (£623 million EV) currently trades at 20x LTM EBITDA, and Halma plc (£8.7 billion EV) trades at 24x LTM EBITDA.

Figure 21: Market Valuation of SDI

Intrinsic Value Methodology

Valuing a serial acquirer is always challenging. I have a simple framework of thinking about the valuation of a serial acquirer such as SDI. This basically involves two steps:

1. Valuing the existing business: We first value SDI’s existing business as of today. That is, we value SDI’s business including all acquisitions which SDI has completed up to date. We take a conservative level of organic growth. However, for this step, we assume SDI’s stops acquiring new businesses going forward. This gives us a level of stable free cash flow that can be generated by the existing business, helping us access the intrinsic value of the ‘as-is’ SDI and also understand the amount of free cash flow which can be invested towards new acquisitions in step 2. We also adjust for net debt from the existing business.

2. Valuing the new acquisitions potential: In the second step, we take the free cash flows of the existing business and using by certain assumptions such as percentage of free cash flow invested in acquisitions, multiple of EBIT paid, and organic growth rate in EBIT post acquisitions, try to compute the intrinsic value which can be generated from new acquisitions over the next 4-5 years.

Summing up these two intrinsic value estimates gives us the overall intrinsic value of SDI.

Key assumptions

SDI’s Existing Business DCF Assumptions

1. We first make a downward adjustment to SDI Digital Imaging historical revenue for covid related one-time sales of £8 million in FY2022 and £8.7 million for the LTM period ended October 2022. Then we take an assumption of 5% annual organic revenue growth. This assumption is based on:

a. SDI management’s target organic growth rate of high single digits.

b. SDI missed this organic growth target in FY2019 (5.0% organic growth), FY2020 (3.7% organic growth). Further, excluding covid one-time sales, SDI’s organic revenue decreased by 16% in FY2021.

c. SDI’s organic revenue growth in H1 FY2023 was only 3.8%. In fact, after adjusting for Covid related revenue, the organic growth in H1 FY2023 was ~1%.

Accordingly, I believe a 5% organic revenue growth is a reasonable assumption to take.

2. We also take a 5% organic growth in Sensors and Control segment for the above reasons.

3. We assume that SDI will ship another $4 million of Atik Cameras to the Chinese PCR manufacturer in H2 FY2023, and separately add the EBITDA (net of tax) from that order to SDI’s enterprise value.

4. We adjust for the full impact of FY2022 (Safelab and Scientific Vacuum Systems) and FY2023 (LTE Scientific and Fraser Anti-Static) acquisitions.

5. We assume that SDI’s digital imaging and sensors and control segments will maintain the EBITDA margins at the levels witnesses during the LTM period ending October 2022.

6. Maintenance capital expenditure of 3% of revenue. This is slightly lower than the average of 4% during the last 5 years.

7. Working capital stabilized at 12% of revenue, in line with levels seen prior to FY2021.

8. UK tax rate of 25%.

9. Discount rate of 10%.

10. Exit EV / EBITDA multiple of 12x. Conservatively assuming a lower exit multiple as SDI currently trades close to 13x LTM EBITDA.

For more details, refer to the discounted cash flow model included in the PDF report.

Figure 22 below includes the revenue projections of SDI’s existing business.

Figure 22: SDI Projected Revenue of Existing Business

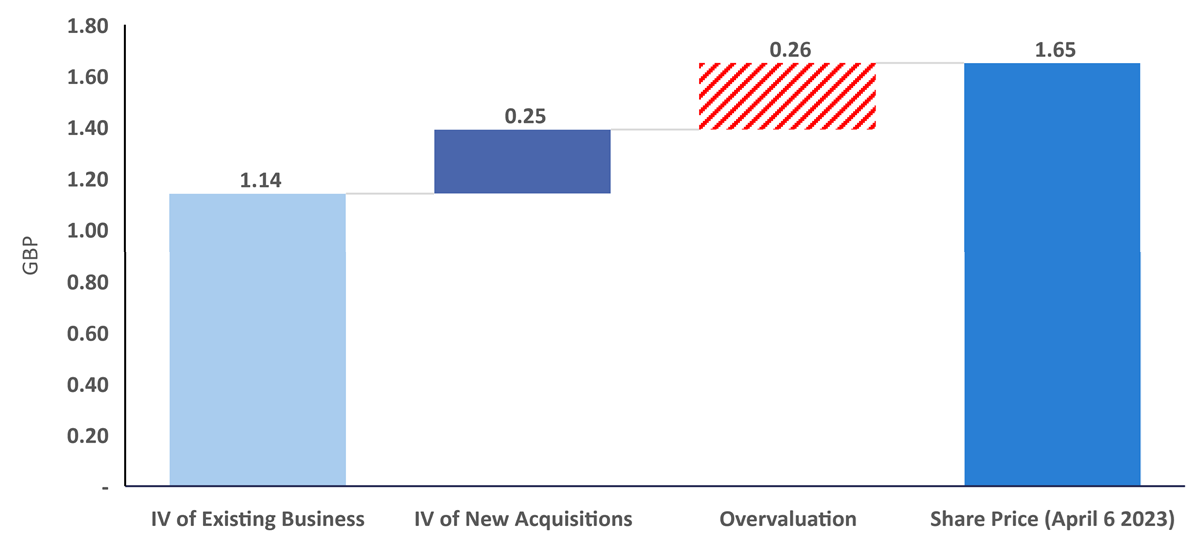

Based on the above assumptions the intrinsic value per share of SDI’s existing business is £1.14.

Figure 23: Sensitivity Analysis on SDI’s Existing Business Value per Share (£)

New Acquisitions Value

SDI’s New Acquisitions DCF Assumptions

1. SDI invests 80% of the free cash from existing business for new acquisitions.

2. Acquisitions are completed at an EV / EBIT multiple of 6x. This is lower than the median multiple of 6.9x paid by SDI for historical acquisitions. However, I assume that SDI will be able to realize synergies after the acquisition effectively lowering the EV / EBIT multiple paid for target companies.

3. Organic growth of 5% in EBIT for the acquired businesses (in line with the existing businesses).

4. New businesses are acquired in the middle of the financial year.

5. Capex and depreciation are equal to each other.

6. No additional working capital required.

7. Acquisitions related cost of 5% of price.

8. Discount rate of 10%.

9. Exit EV/ EBIT multiple of 15x.

10. We don’t consider the additional leverage which SDI might take to carry out the acquisitions.

Figure 24: Projected Free Cash Flow from New Acquisitions

Based on the above assumptions the intrinsic value per share of new acquisitions is £0.25.

Figure 25: Sensitivity Analysis on Intrinsic Value Per Share from New Acquisitions (£)

Valuation Summary

Figure 26: SDI Valuation Summary

Based on the above analysis the intrinsic value per share of SDI is £1.39, which is 16% below the current share price of £1.65. However, as investors might have different risk tolerances and viewpoints on SDI’s business, such as a higher assumption on organic growth, you can sum up the different values from sensitivity tables in Figure 23 and Figure 25 to come to your own estimate of intrinsic value. For example, it is not difficult to see a scenario in which SDI is valued fairly. An 8% revenue growth rate during the next 5 years in existing and acquired businesses, while paying 6x EBIT multiple for new acquisitions, the intrinsic value per share reaches close to £1.60. I will leave it to you to decide what the fair valuation of SDI is for you. Because of the reasons I discussed earlier, growing at 8% organically would be challenging, and 5% seems more reasonable. Accordingly, SDI currently does not present a compelling entry point.

Figure 27: SDI Valuation Summary Graph (£)

I. Risks

Key man risk: There is an element of key man risk with the possibility that Mike Creedon might leave. However, all subsidiaries of SDI function autonomously with their own managements. What would be impacted is the M&A function which Mike is heavily involved in. The new CFO, Ami Sharma, comes from an acquisitive company which helps mitigate the risk to some extent. However, low insider ownership increases this risk.

Wrong acquisition risk: SDI has recently started doing larger acquisitions. If SDI acquires a terrible business, it can weigh down the current cash flows. This risk is present is all serial acquirers.

Lack of precise market data: Due to the niche nature of SDI’s businesses, it is often not possible to know exactly who the competitors are or the estimated market size of the industries. In other words, when SDI claims that it is the market leader in ‘xyz’ product, it is difficult to corroborate the same through independent data sources.

Exposure of customer capex cycle: Around 60% to 65% of SDI’s revenue is one-time capital expenditure for its customers making it prone to discretionary spending risk.

Technological risk: if SDI is not able to innovate or keep up with new technologies within medical and scientific equipment, the business can become challenging. This risk is especially present for the business such as Atik Cameras.

J. Conclusion

SDI’s management has done a commendable job of building a truly diversified manufacturing mini-conglomerate. The company has been self funding acquisitions helping it build immense shareholders value. Mike Creedon is a great M&A focused CEO with a terrific capital allocation record. Unfortunately, SDI currently trades above my intrinsic value estimate. Either its price would have to correct downwards, or fundamentals would need to improve a lot (without price changing much) for me to see a sufficient margin of safety. Therefore, I will continue to monitor SDI's performance closely.

K. Useful Resources

Mike Creedon Interviews:

Inpractise Interview: SDI Group: Niche Manufacturing Serial Acquirer | In Practise

Acquirers.com Interview: SDI Group Interview – Early days of the Halma model (acquirers.com)

Andrew Brown Interview: (1) SDI Group CEO Mike Creedon Interview - YouTube

Earnings Calls:

SDI GROUP PLC - Full Year Results - YouTube

Issuer Paid Analyst Reports:

Thanks

Thank you for reading. Please share any comments or suggestions below. You can also write to me at Fairwayresearch@gmail.com or find me on Twitter. Fairway Research’s goal is to do a tremendous amount of research on a small group of companies. So if the newsletter is adding value to you or your team, please share it with your friends and colleagues. I enjoyed researching SDI and I hope you liked learning more about it. By the way, here is a picture of my cluttered desk as I finish publishing this deep dive.

Professionally structured with great visuals. A masterpiece man. Well done!

This is so well-researched and thorough. I'm impressed. Well done!