TerraVest Industries (TSX: TVK)- Q2 FY2023 Review

Organic Growth Propels Strong Quarter Results

TerraVest content repository: You can find a great collection of reports, write-ups, podcast mentions, YouTube videos, and presentations on TVK on this page.

Note that Fairway Research is long TerraVest shares. This is not investment advice. Please do your own due diligence before investing.

Highlights

Consolidated revenue in Q2 FY2023 increased by 28% including 20% organic revenue growth.

Growth was driven by buoyant demand from oil & gas customers in both the Processing Equipment and Service segments. Compressed Gas segment also performed well with 32% revenue growth during the quarter. HVAC equipment segment was flat.

Canadian revenue grew at 2x the U.S. revenue during the quarter driven by demand from Western Canada

EBITDA margin during Q2 FY2023 increased to 18.2% as compared to 15.4% in Q2 FY2022. This was driven by higher margins in both Processing Equipment and Service segments.

TerraVest continued its acquisition driven growth strategy by acquiring Secure Energy’s drilling services business for $16 million.

Based on better than expected results during the last twelve month period, especially the growth witnessed by the Service segment’s and the improved overall EBITDA margins of TerraVest’s business, my estimate of the intrinsic value of the ‘existing business’ of TerraVest is now updated to $35.1 per share from $29.6 in February 2023. The estimate is still does not consider any growth from acquisitions, and takes nominal 2% revenue growth beyond FY2023.

Detailed Quarter and Half-Year Review

Consolidated Revenue

Consolidated revenue for Q2 FY2023 increased by 28% and for H1 FY2023 by 32%. The service and processing equipment segments were the primary contributors to the increase in revenue. In terms of geography, Canadian revenue increased by 37% in Q2 FY2023, and U.S. revenue increased by 18%.

Organic revenue growth during the Q2 FY2023 was 20%, and H1 FY2023 was 8%. The Processing Equipment segment and the Service segment again drove this.

Figure 1: Revenue Breakdown

HVAC Equipment Segment:

Revenue for the HVAC equipment segment was flat quarter-on-quarter and increased by only 2% in H1 FY2023. Organic revenue was down 2% in Q2 FY2023 and increased by 1% in H2 FY2023. The segment witnessed stronger demand for home heating equipment, but it was offset by lower demand for refined fuel tanks.

Compressed Gas Segment:

Revenue for the Compressed Gas segment increased by 32% in Q2 FY2023 and by 38% in H1 FY2023. However, this increase was primarily attributable to the acquisition of MTC. Organic revenue growth was 2% in Q2 FY2023, and 7% in H2 FY2023. The slight increase in revenue was due to stronger demand for compressed gas storage and distribution equipment.

Processing Equipment Segment:

Revenue for the Processing Equipment segment increased by 24% in Q2 FY2023 and by 22% in H1 FY2023. The entire growth was organic and driven by higher demand for energy processing equipment in Western Canada.

Service Segment:

Revenue for the Service segment increased by 77% in Q2 FY2023 and by 103% in H1 FY2023. However, this increase was primarily attributable to the acquisition of GES in November 2021. Organic revenue growth was 28% in H2 FY2023. The segment benefitted from strong demand from customers due to increased rig utilization and recent asset acquisitions which increased overall capacity.

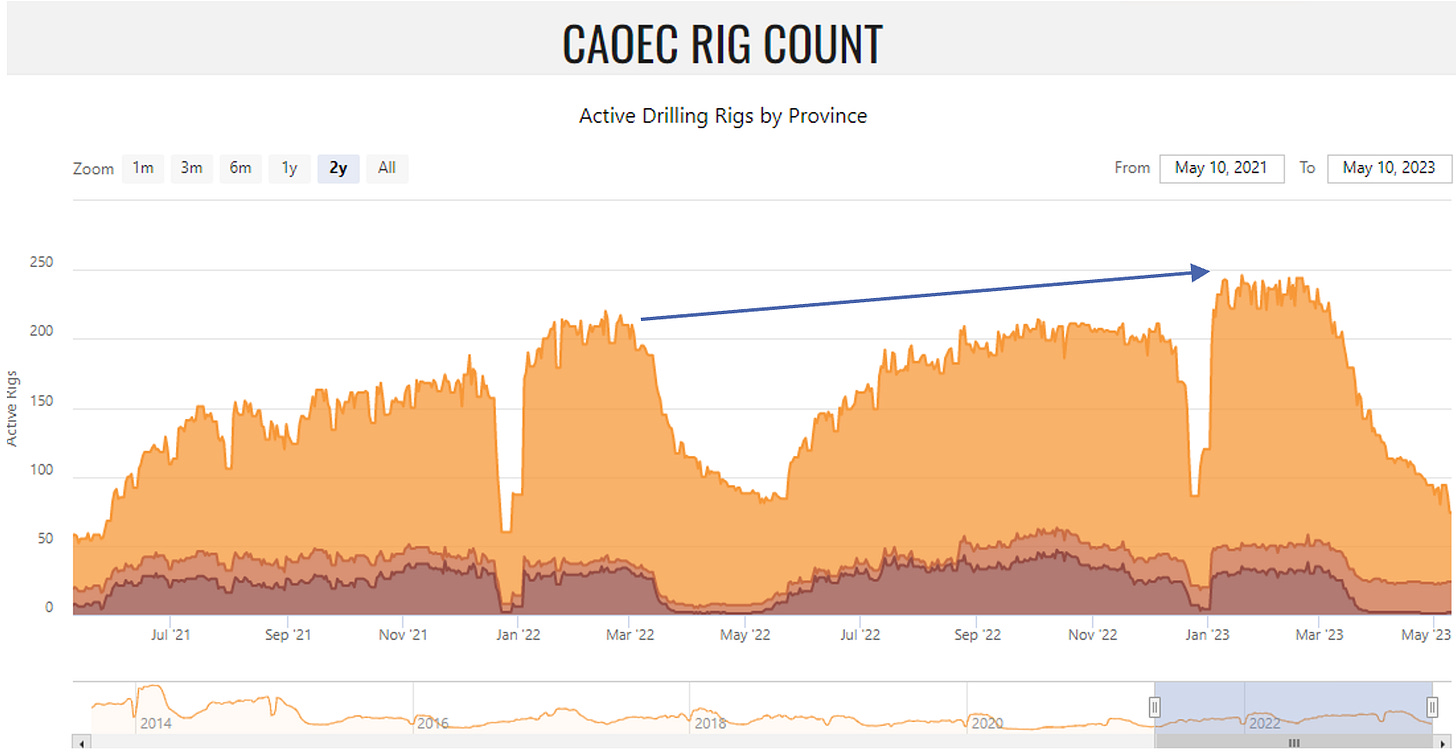

Figure 2: Active Rigs in Western Canada

The Processing Equipment and Service segments generally experience higher sales in the first and second quarters as the majority of the drilling in Western Canada occurs during this period. As can be seen from the chart above (Figure 2), drilling activity slows down around April each year.

Reported EBITDA

TerraVest’s consolidated EBITDA increased from $21.2 million in Q2 FY2022 to $32.2 million in Q2 FY2023. EBITDA margin increased from 15.4% in Q2 FY2022 to 18.2% in Q2 FY2023. Consolidated EBITDA increased from $41.5 million in H1 FY2022 to $62.5 million in H1 FY2023. EBITDA margin increased from 15.4% in H1 FY2022 to 17.6% in H1 FY2023. The increase in EBITDA was driven by the following factors:

Gross margin improvement at the consolidated level from 22% in Q2 FY2022 to 25% in Q2 FY2023, and from 22% in H1 FY2022 to 24% in H1 FY2023. This is despite increased steel commodity prices during Q2 FY2023.

Increased revenue and margin improvement in the Processing Equipment Segment. The segment’s EBITDA margin doubled from 7% in Q2 FY2022 to 15% in Q2 FY2023, and 5% in H1 FY2022 to 11% in H1 FY2023.

Increased revenue and margin improvement in the Service segment. The segment’s EBITDA margin increased from 21% in Q2 FY2022 to 28% in Q2 FY2023, and 18% in H1 FY2022 to 27% in H1 FY2023.

Figure 3: EBITDA Breakdown

Working Capital

The high working capital levels seem to be slowly normalizing. Working capital as of March 2023 was at 30% of revenue, down from the levels of 34% as of September 2022 and 46% as of September 2021.

Acquisitions

On March 1, 2023, TerraVest acquired the assets of Secure Energy (Drilling Services) Inc.(“SES”) for $16 million. SES provides on-site water sourcing, filtration, pumping, storage, and heating services. SES activities and results have been fully integrated into one of TerraVest’s existing subsidiary’s financial results and activities. The acquisition multiple cannot be determined based on the information disclosed by the company.

Normal course issuer bid

On March 15, 2023, TVK announced the renewal of its normal course issuer bid for up to 949,963 shares (10% of public float) before March 2024. There were 17,831,318 shares outstanding as of March 7, 2023. TVK bought back 43,100 common shares in FY2022 (1,233,826 in 2021).

Financial Highlights

Figure 4: Financial Overview

Intrinsic Value of existing TVK (without acquisition value)

In my February 2023 deep dive, I estimated that the intrinsic value of TerraVest’s existing business is $29.6 per share. That estimate was based on highly conservative assumptions.

My estimate of the intrinsic value of the existing business is now updated to $35.1 per share. The increase is driven by the following updates to the discounted cash flow valuation model:

Revenue estimate for FY2023 now increased to $692 million as compared to $623 million. This was primarily driven by TerraVest revenue performance during the last twelve months which sets revenues at $662 million.

EBITDA margin estimate for FY2023 now increased to 16% based on TerraVest’s last twelve month EBITDA margin of 16.6%.

Long-term EBITDA margin expectation has now been increased to 14.5%, as compared to 14% in February deep dive. This change is based on better than expected margin performance of the Processing Equipment segment and the Service segment during H1 FY2023, and the increased weighted on the high margin Service segment in TerraVest’s overall portfolio.

Figure 5: Share Price Vs. Intrinsic Value Estimate

The intrinsic value estimate of $35.1 per share implies an LTM EBITDA multiple of 8.0x as compared to the current traded LTM EBITDA multiple of 6.8x.

Other updates:

Note on seasonality:

TerraVest’s operating segments are seasonal in nature. The strongest quarters for TerraVest are its first and last quarters. The Processing Equipment and Service segments generally experience higher sales in the first and second quarters as the majority of the drilling in Western Canada occurs during this period. The HVAC Equipment and Compressed Gas Equipment segments generally experience higher revenues during the first and last quarter as demand for residential, commercial, and industrial heating products increases heading into the winter months. The third quarter is typically the weakest across all segments.

TerraVest takes advantage of this seasonality to build inventory levels during non‐peak demand periods, thereby allowing TerraVest to more readily meet increased levels of demand during its regular peak demand periods.

TVK at NGPA Nashville Summit (April 2023):

TVK’s full propane lineup was visible at the National Propane Gas Association (NPGA) summit at Music City Centre, Nashville from April 23-25, 2023. Infant TVK had the biggest exhibition room at the event. In 2022, there were 4,100 people in attendance at this event.

Thanks for reading. Please share any comments and feedback below. You can also find me on Twitter or email me at fairwayresearch@gmail.com.

I would love an update given all their M&A since this last article. Not to mention the increased cost of debt servicing.