Valuing Fairfax India's Crown Jewel $FIH.U

Bangalore International Airport's intrinsic value and implications on FIH NAV discount

“Fairfax India’s current discount to NAV is so undemanding that just the value of its non-airport investments (the majority of which are publicly traded), net of corporate borrowings is nearly equal to the current market capitalization of the company; meaning investors today are getting the airport for free.” – Trevor Scott, Tidefall Capital LP, Q4 2022 Letter

Introduction

Fairfax India Holdings Corporation1 (TSE: FIH.U, “FIH”) is the investment vehicle used by Fairfax Financial (Prem Wasta) for making investments in Indian public and private companies. It is a unique equity vehicle, which gives Canadian investors exposure to Indian businesses. In this short report, we use the discounted cash flow model to estimate the intrinsic value of Bangalore International Airport Limited, which represents almost half the net asset value of FIH.

Intrinsic Value Methodology

Because FIH operates similar to a fund, the best way to estimate the intrinsic value of FIH is to analyse its net asset value (“NAV”). Before computing NAV, it is important to note how FIH accounts for its investments.

FIH’s Investments are carried on the balance sheet at fair value (instead of cost). Accordingly, the book value of FIH should closely follow the market value or fair value of investments. Further, FIH’s investments in public listed companies are simply valued using their respective market prices and investments in non-listed private companies are valued using internal valuation models such as discounted cash flow. However, retail investors do not have access to such models and accordingly getting comfort around the NAV of FIH can be challenging.

The biggest investment within FIH is its 49% equity stake in Bangalore International Airport Limited (“BIAL”), which operates one of India’s largest airports. At FIH’s internal fair value estimate of $1.26 billion, the BIAL investment alone accounts for 45% of the NAV.

While I do not believe markets are always efficient, as an investor I can take comfort in the fact the public investments of FIH can be, at minimum, sold at market prices. It really just comes down the how an investor can get comfortable around the BIAL fair value. After all, it is a large private investment in an emerging market infrastructure asset where I do not know what exactly went into the FIH’s valuation model. But the more I know the lesser my risk. Hence, I choose to dig into 400 page annual reports and several regulatory filings to get some sense of the intrinsic value of BIAL.

Bangalore International Airport

Situated in Southern India, Bangalore is one of the fastest growing cities, not just in India, but in Asia pacific as well.

Growth before the pandemic

Prior to Covid-19, BIAL showed impressive growth in passenger figures growing at 13% CAGR from 11.6 million in FY2011 to 26.9 million in FY2018. Note that during FY2011 to FY2018, BIAL only operated terminal 1 which had a capacity of 26.5 million passengers per year. So BIAL was running fairly above capacity by FY2018.

Impact of Covid-19

Of course, just like any airport in the world, BIAL was impacted by several waves of Covid-19. Passenger numbers fell from 32.4 million in FY2020 to 11 million in FY2021, before recovering partially to 16.3 million in FY2022. It is heartening to know that even in the middle of the pandemic, BIAL maintained positive EBITDA.

Regulated revenue

BIAL makes revenue through primarily through two sources. First being aeronautical (aero) revenue earned from activities relating to operations of aircrafts and cargo.2 Second is non-aeronautical revenue, which includes car park, retail, real estate, advertising etc. The aeronautical part of the revenue is regulated by Airports Economic Regulatory Authority (“AERA”) which comes out with a rate order for every 5-year period3. AERA takes into account several things while setting the aeronautical revenue rates, such as fair return on equity, capital expenditure, operating expenditure and non-aero revenue. In 2021, AERA come out with its tariff order for BIAL for the period FY2022 to FY2026. It includes detailed projections relating to BIAL’s revenue, costs and capex for this period. While, BIAL might underperform or over achieve these projections, these projections serve as a guide post for estimating the free cash flow and intrinsic value of BIAL.

Revenue Projections

The traffic projections are the key input in every airport. In November 2022, BIAL completed the construction of phase 1 of terminal 2, doubling its capacity from 26.5 million passengers per year to 52.5 million passengers. AERA’s 2021 order estimated that that the passenger traffic at BIAL will fully recover in FY2023 to reach 31.2 million. They seem to be right, as BIAL has already processed 16.3 million customers between April 2022 and October 2022. That is, they have already surpassed FY2022 traffic figures within 7 months of FY2023 and are on track to do volumes of around 30 million in FY2023.4

While FIH has future plans for construction of Terminal 2 phase 2 and Terminal 3, the airport in its current state is expected to operate at 94% of capacity by FY2026. Higher traffic will fuel higher aero and non-aero revenue for BIAL during the projection period.

EBITDA margin

There are significant scale advantages to operating an airport. Prior to the pandemic, in FY2019, BIAL had an EBITDA margin of 69%. While the margin dipped during the pandemic, but remained at a respectable 40% in FY2022 even with half the passenger traffic. It is expected to increase to 75% by FY2026. BIAL’s major expenses such as personnel expenses and O&M demonstrate high economies of scale. The only expense expected to proportionately increase with revenue is the concession fee, which is set at 4% of aero revenue.

The Hyderabad airport (operated by GMR) which is also located in South India, reported an EBITDA margin of 60% in H1 FY2023. Given the historical EBITDA margins witnessed by BIAL prior to the pandemic and the fact the closest major airport also has reasonably high EBITDA levels, gives me comfort that EBITDA projections for BIAL are reasonable.

Capital Expenditure

Airports are capital intensive. As per AERA, BIAL will incur total capital expenditures of close to $1.06 billion during FY2022 to FY2026. Majority of this is for completion of Terminal 2 and other fresh projections. However, as of March 2022, BIAL has already spent $623 million (capital work in progress on the balance sheet). Hence, for the projection period of FY2023 to FY2026, BIAL will only need to spend the remaining $442 million of capex.

BIAL Discounted Cash Flow Valuation

FIH fair values its stake in BIAL at $1.26 billion as of September 30, 2022. If we do a simple back calculation, considering the projections discussed above, and taking a 13% discount rate5, BIAL will need to go for an IPO or sale at 17.5x EV / EBITDA multiple at the end of FY2026 to reconcile with FIH’s fair value estimate of $1.26 billion.

BIAL’s competitor in the Indian airports space, GMR, which operates the Delhi and Hyderabad airports, currently trades at 21x LTM EBITDA. Accordingly, sticking with 17x EBITDA multiple seems conservative.

While the above DCF valuation seems reasonable, I note the following:

BIAL is a growing infrastructure asset which is yet to fully expand to its potential. AERA vetted cash flows do not take into account the construction of terminal 2 phase-2 and terminal 3 (these can easily take passenger capacity of the airport to 90 million plus per year from the current 52.5 million).

If FY2023 is any indication, BIAL will likely surpass the current AERA projections to some degree

There can be significant upside beyond FY2026 from the 400 plus acres of adjoining land to the BIAL airport

Other indications of relative value

In September 2021 OMERS bought 11.5% interest in BIAL. The transaction valued 100% of BIAL at $2.6 billion. This value is also pretty much in line with the both FIH internal fair value estimate and intrinsic value estimate based on the above DCF.

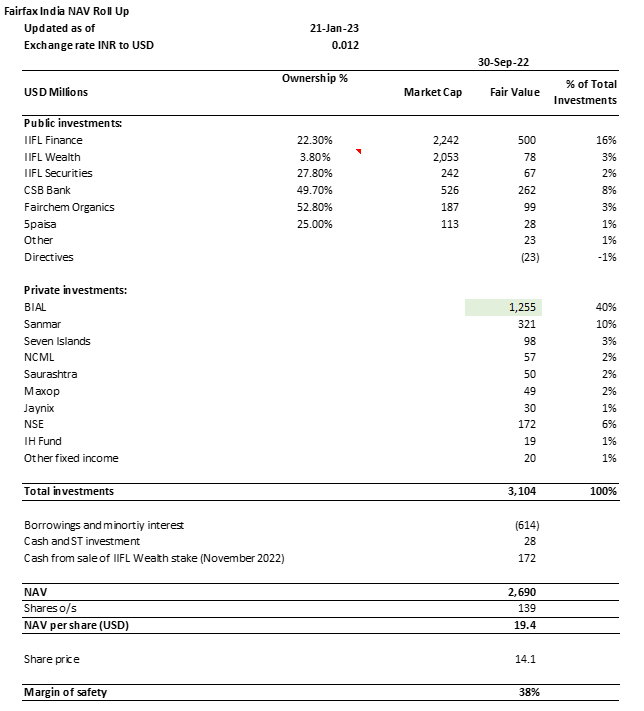

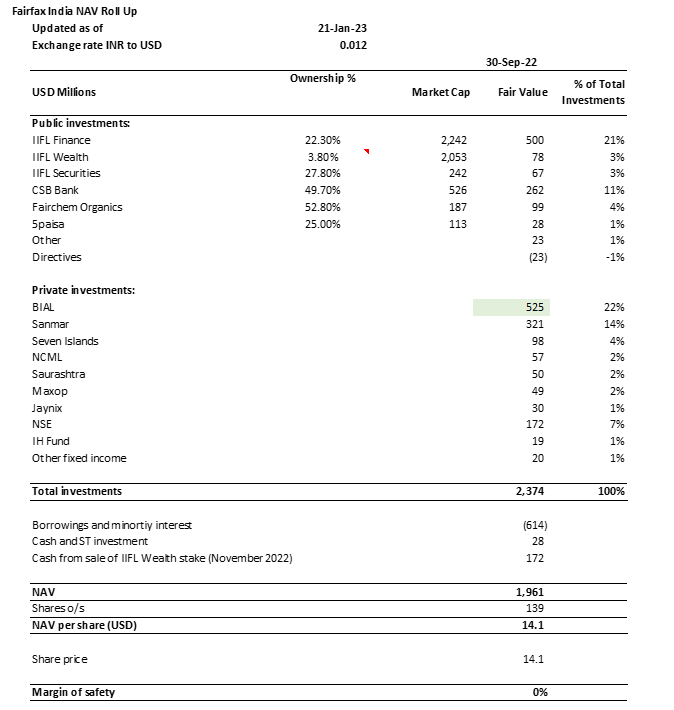

FIH’s discount to NAV

As shown in Figure 9 below, if we accept FIH’s current valuation of BIAL equity stake, then FIH is trading at 27% discount to NAV. In other words, the share price has to increase by 38% from the current levels to meet the intrinsic value (this represents my margin of safety). We can also turn this around, and back calculate the fair value being ascribed by the market to FIH’s BIAL equity stake, which comes to $525 million (See Appendix 1). Implying a 100% valuation of BIAL at close to $1 billion. As of today, that scenario is unlikely.

Other private equity investments of FIH

There is of course the risk that, as an investor I cannot get comfort around the intrinsic value of other private equity investment which are valued at $816 million. They make up 30% of the NAV. The deviation in value of these investments is a known risk.

Conclusion

Given the above discussion around the valuation of BIAL, FIH’s biggest investment in India, I estimate that the intrinsic value of FIH is somewhere close the current NAV of $19 to $20 per share. The discounted cash flow valuation based on AERA projections gives me sufficient comfort around BIAL’s intrinsic value. FIH has previously traded at above NAV (see figure 10) and the discount to NAV can quickly close as investors see an improvement in BIAL’s results or an earlier push for an IPO.

Fairway Research thanks Trevor Scott (@TidefallCapital) for covering Fairfax India in his Q4 2022 newsletter.

This document is only for educational purposes. Fairway Research holds a long position in Fairfax India.

Yes, I know that Fairway and Fairfax sound similar, but we are not linked in any way. Neither is similar sounding companies one of our company screening criteria.

Aero revenue is charged in the form of user development fees and landing charges.

These periods are called control periods. The latest being the Third Control Period, decided in 2021.

https://indianexpress.com/article/cities/bangalore/bengaluru-airport-highest-passengers-deepavali-8251910/

Hi. Nice write up. Where did you find the financial information of BIAL ?

I read in the Q1 2023 report that FIH is trying to by another 10% stake in the airport from Siemens at a valuation of around $2.5B. Any thoughts on that?